Hip Hop and Credit Management

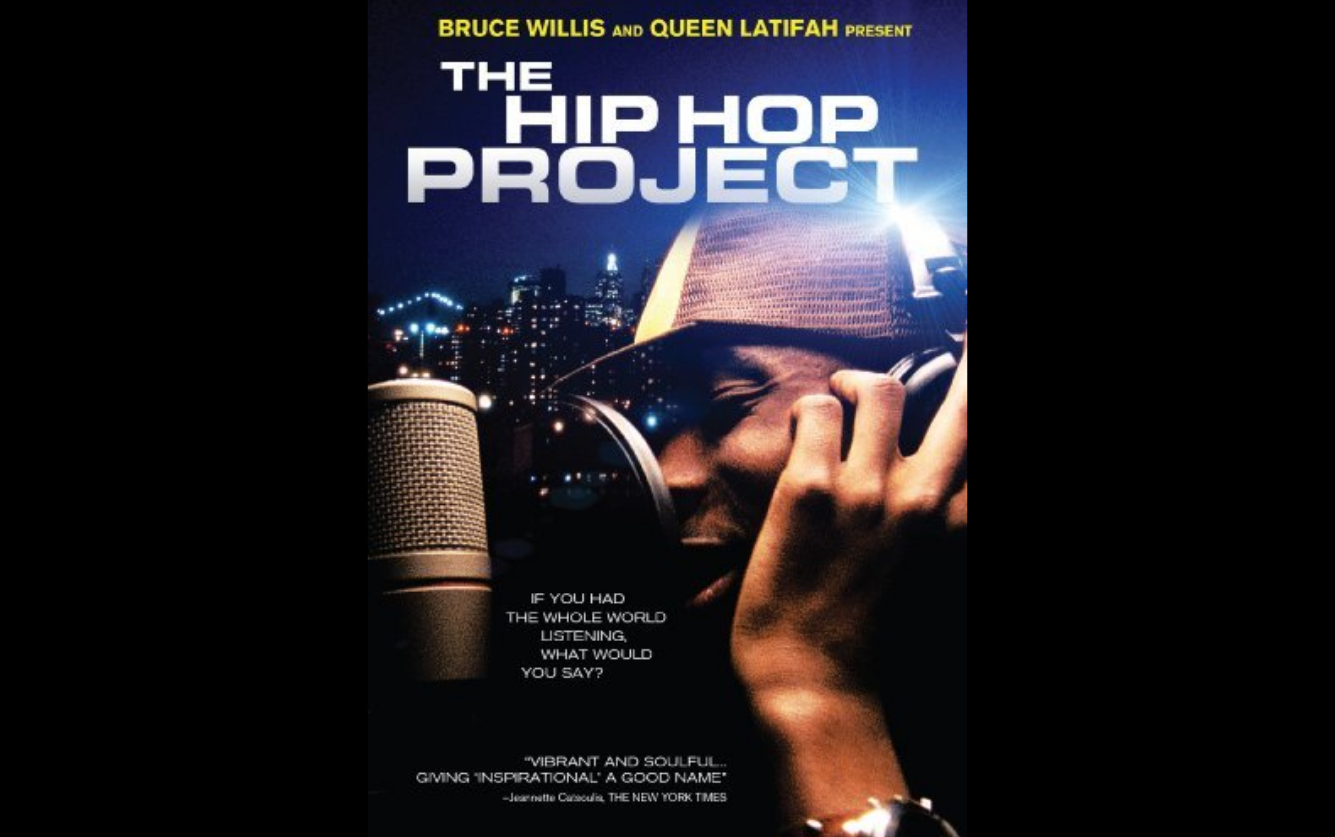

Hip Hop & Credit Management: Advice to Credit Professionals in 30 Seconds Several years ago, I was given the opportunity to view a documentary,...

The words rumbled like daunting thunder from the mouth of a tall, lanky and otherwise nondescript bank branch manager. Although he was referring to fraudulent charges on an account, the same adage applies to those who secure credit through UCCs, mechanic’s liens or pursue collections.

I can’t say it with quite the same Armageddon-like-bellow, but I’ll strain to be tip-toes-tall and use the lowest voice I can muster, to repeat “supporting documents can make or break a claim”. Because it’s worth repeating, if for nothing more than a bit of a giggle while I try not to lose my balance.

Regardless of whether you are pursuing a UCC, mechanic’s lien or collection, these are documents you should always have handy:

Short list huh? Well, hang tight, we’re not done. Let’s delve a bit deeper, and uncover the important documentation based on service type.

If you are securing rights through the mechanic’s lien process, the list of necessary documentation can fluctuate – meaning, you tend to need more supporting documentation and information for a mechanic’s lien than you would for a preliminary notice. In an ideal credit-management-world, you would want to have ALL of this documentation (remember, ideal, not required):

Generally, when serving a preliminary notice, you would want to include the information that will ensure the proper parties are served with a copy of the notice. This would include knowing who is in the contractual chain (owner, GC, debtor, surety, lender etc.) and can often be found on job information sheets, contracts and Notices of Commencement.

Once you are at the point where you are unpaid and disputes arise forcing you to pursue a mechanic’s lien or even collections, that’s when you will want to refer to open invoices, statement of account, joint check agreements, personal guarantees etc. Which leads to a great segue...

We have covered this before, so I won’t rehash it too much. The best advice is to provide as much information as you can. When it comes to pursuing collections or suit, it’s almost always better to have more documentation than not enough documentation (kind of like cake, more cake is better than less cake). Aside from the “usual suspects” spelled out above, be sure to include copies of correspondence, copies of returned/NSF checks and copies of credit reports.

If you are filing a UCC, it’s a bit less about the backup documentation, and more about ensuring all necessary information is incorporated into your Security Agreement. In the event you are pursuing collections and intend to use your UCC filing as leverage, you will want to ensure you provide the collections agency with a recorded copy of the UCC filing, results from a recent UCC search, a description of the collateral and the amount you are owed.

Maintaining documentation is important – not only for proceeding with secured transactions, but simply as a good business practice.

Hip Hop & Credit Management: Advice to Credit Professionals in 30 Seconds Several years ago, I was given the opportunity to view a documentary,...

Four Signs Your Customer May Be in Financial Distress Business failure is inevitable. It is imperative that you, as a creditor, protect yourself from...

Will I Ever Receive Payment on Old Judgment Liens and Mechanic’s Liens? Will you receive payment on old judgment and mechanic’s liens? Short answer: ...