Managing lien waivers can be complicated and time-consuming. Construction projects involve multiple invoices, progress payments, and stakeholders. This complexity makes it easy for errors or delays. A clear process that combines technology and expert review can make the waiver workflow more efficient, accurate, and reliable, while protecting financial interests and project rights. With the right tools and oversight, managing lien waivers becomes simpler and more predictable.

How AI and Automation Can Help with Lien Waivers

Technology and automation can handle repetitive, time-consuming tasks, ensuring nothing slips through the cracks. For example, automated systems can:

- Check waiver completeness and verify all required fields, dates, and signatures are included before sending

- Generate lien waivers automatically based on payment status, contract terms, and project details (like the project state), reducing manual errors

- Track deadlines and compliance requirements, alerting the team to important milestones and preventing missed filing windows

- Monitor payment status and flag invoices that are partially paid, overdue, or fully cleared, helping ensure waivers match actual payments

- Flag exceptions for expert review and identify unusual situations, such as partial payments or disputed invoices, so a credit professional can handle them efficiently

Even with technology managing routine tasks, human review is essential. Credit professionals verify accuracy, payment status, and compliance, ensuring that issuing a waiver does not compromise legal or financial rights.

What a Lien Waiver Policy Looks Like

A solid lien waiver policy outlines how waivers are handled at every stage of a project. A clear process ensures the team knows what to do, when to do it, and how to document it properly. A typical policy covers:

- When to issue waivers: for example, after receipt of partial or full payment

- Which type of waiver to use: conditional vs. unconditional and partial vs. final, depending on payment status

- How internal approvals work: who reviews, signs off, notarizes as needed, and coordinates with accounts receivable or legal teams

- How waivers are tracked and stored: centralized systems for easy retrieval and audit purposes

Having a documented process reduces confusion, prevents errors, and keeps projects moving smoothly. It also provides transparency for stakeholders, including contractors, suppliers, and project owners, which helps strengthen relationships and maintain trust.

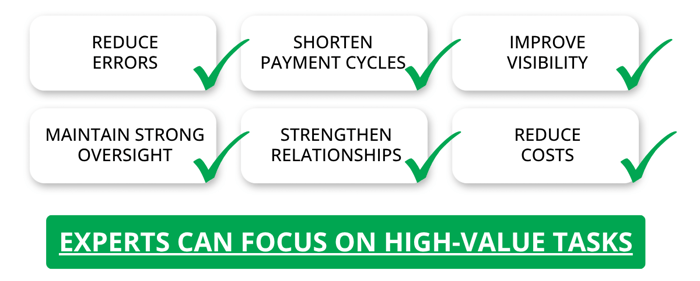

Benefits of Automating Lien Waivers

Automation helps your team work smarter while protecting your rights.

Reduce Errors

Manual processing can lead to mistakes like incorrect dates, amounts, or contract language. Technology ensures waiver language is accurate and includes all critical details, reducing the risk of waiving rights prematurely or sending corrected documents. Companies using automation report up to a 70% reduction in waiver errors.

Shorten Payment Cycles

Automated waivers reach the right party faster, helping projects move forward and allowing businesses to receive payments faster. On average, automation can shorten payment cycles by 10–15 days, keeping cash flow steady.

Improve Visibility

Technology provides real-time insight into waiver status: pending, approved, or completed. You can monitor progress, spot delays early, and act before deadlines are missed, without digging through emails or spreadsheets.

Experts Can Focus on High-Value Tasks

With routine work handled automatically, credit professionals can focus on exceptions, risk mitigation, and strategic decisions. Imagine saving several hours per week per project to handle complex situations more efficiently.

Keep Oversight Strong

Even the best technology is only as effective as human review. Credit professionals verify compliance, confirm funds have cleared, and manage unusual scenarios, reducing compliance issues by over 50%.

Strengthen Supplier Relationships

Timely, accurate waivers demonstrate that your business is organized and reliable, improving trust and collaboration. Contractors are more likely to prioritize payments with vendors who submit accurate waivers on time.

Reduce Costs

Automated workflows cut manual work, minimize errors, and eliminate unnecessary steps. A mid-sized construction firm could save $10,000–$15,000 annually in labor and error correction costs by automating its waiver process.

Why Lien Waivers Matter

Lien waivers protect both the party making the payment and the party receiving it. They provide a formal acknowledgment that payment has been made for the labor or materials provided. Using the right waiver at the right time is critical.

Which Type to Lean On

Conditional waivers are ideal. A conditional lien waiver will specify the waiver is conditioned upon receipt and clearance of the payment amount. If the payment is not received or fails to clear, the waiver will not apply.

Conditional lien waivers are preferred over unconditional lien waivers, because the “conditions” provide you with leverage, in the event payment is not received or does not clear.

Which Type to Avoid

Unconditional lien waivers can be dangerous, especially if blindly signed, because you waive all rights to further remedy regardless of whether payment is received or cleared.

A common mistake is signing an unconditional waiver upon sending an invoice or before funds are confirmed. This can lead to lost leverage, delayed payments, or disputes that are harder to resolve.

What about Final Payment?

Paid in full? You may be inclined to execute an unconditional final waiver, but to err on the side of caution, we recommend you use a conditional waiver and release on final payment. Always protect your rights and remedies.

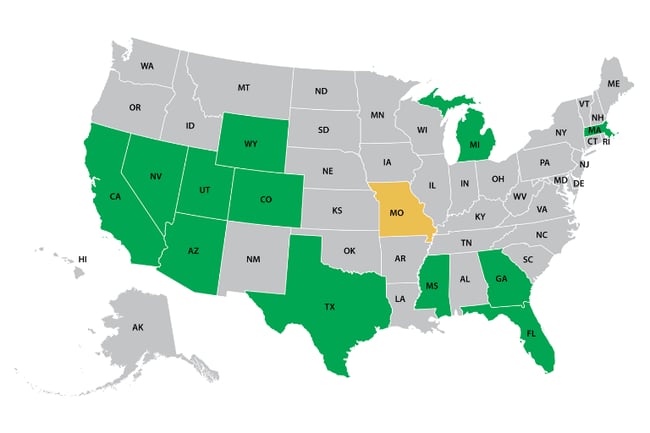

Caution with State Requirements

With technology, you can ensure appropriate lien waiver templates are in place. While a more generic lien waiver template may work, it’s important to remember there are states which require a specific lien waiver format, template, contents, and in some cases, notarization. States like Arizona, California, Colorado, Florida, Georgia, Massachusetts, Michigan, Mississippi, Missouri (residential projects), Nevada, Texas, Utah, and Wyoming, all have specific lien waiver requirements.

How AI and Experts Can Work Together

So, which tasks in the lien waiver process should be automated? While it will depend on your business needs, here’s a sample workflow showing how technology and human expertise can handle lien waivers together:

|

Task

|

Responsible

|

Description

|

|

Invoice Generated

|

Technology

|

Monitors billing schedule or payment terms and flags when a partial or final payment is made.

|

|

Determine Lien Waiver Type

|

Technology

|

Determines whether a conditional or unconditional waiver is appropriate based on payment status, project stage, and contract terms.

|

|

Draft Lien Waiver

|

Technology

|

Automatically generates a waiver using jurisdiction-specific and contract-compliant language, including key details: project name, invoice amount, dates, and conditions.

|

|

Legal/Payment Context Review

|

Credit Professional

|

Reviews waiver in the context of actual payment status, customer communication, and internal policies. Confirms whether funds have cleared.

|

|

Internal Approval & Coordination

|

Credit Professional

|

Coordinates with AR or legal to approve the waiver and ensure documentation aligns with internal controls and project status.

|

|

Send Waiver

|

Technology

|

Sends the approved waiver to the appropriate party, logs delivery date, and tracks for signatures.

|

|

Monitor Payment Status

|

Technology

|

Continuously monitors bank records or AR systems to confirm receipt of funds tied to the waiver.

|

|

Handle Exceptions

|

Credit Professional

|

If payment is not received, investigates and may initiate follow-up with a customer or take protective action (e.g., intent to lien).

|

|

Waiver Archive

|

Technology

|

Stores signed waivers in a searchable database and cross-references with related invoices, lien rights, and deadlines.

|

|

Audit

|

Credit Professional

|

Reviews waiver use throughout the project to ensure no rights were waived prematurely and updates internal processes based on gaps or risks.

|

Ready to Streamline Your Lien Waiver Process?

NCS Credit’s lien waiver technology combines automation with expert oversight to protect your project rights and speed payments.

Provincial Construction Payment Rights in Canada

Discover your payment rights on provincial construction projects in Canada, including how to secure bond claim rights and navigate Public Works Act claims.

A Quick Guide to Mechanic's Lien Rights in Canada

Explore the essentials of securing mechanic's lien rights in Canada, including deadlines, notice requirements, and key provincial variations.

Know Your Customer. Protect Your Cash Flow in Any Economy.

Strengthen credit relationships by knowing your customer and using UCC filings & mechanic's liens. Learn how to protect your business in any economy.