The 4 Primary Types of Lien Waivers

Lien Waivers are common in construction credit. Project owners will often require lien waivers from contractors, subcontractors & suppliers to alleviate the possibility of mechanic’s lien filings.

There Are 4 Primary Types of Lien Waivers

- Partial Conditional: A signed document agreeing to waive rights to a claim for a dollar amount or through a specified date, conditioned upon receipt and clearance of the partial payment.

- Partial Unconditional: A signed document agreeing to waive rights to a claim for a dollar amount or through a specified date. The waiver is not conditioned upon clearance of a payment. If the check is not received, or does not clear, the client will have waived their rights to that partial payment.

- Final Conditional: A signed document agreeing to waive rights to a claim given conditioned upon receipt and clearance of a final payment. If the client does not get the final payment, the waiver does not waive their rights.

- Final Unconditional: A signed document agreeing to waive rights to a claim. The waiver is not conditioned upon clearance of a final payment. The client’s rights will be waived whether or not payment is actually received or cleared.

“Are lien waiver requirements the same in all states?”

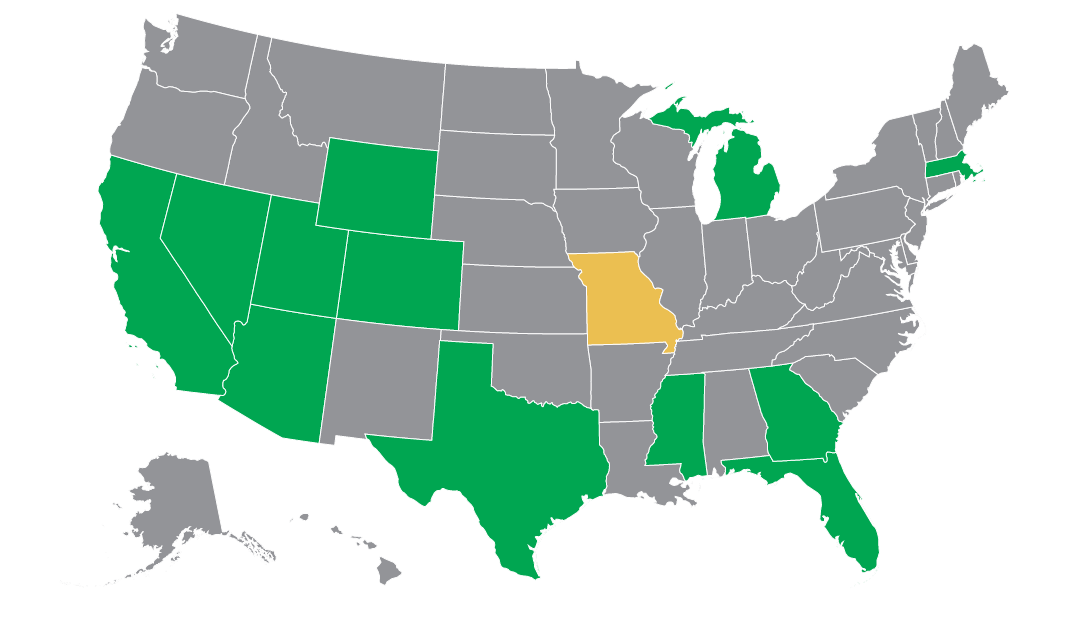

The majority of states do not require a particular lien waiver format; however, there are some states with statutory requirements: Arizona, California, Colorado, Florida, Georgia, Massachusetts, Michigan, Mississippi, Missouri (residential), Nevada, Texas, Utah, Wyoming.

“Is a Lien Waiver the same as a Release of Lien?”

No, and this is a common misconception. A lien waiver acknowledges receipt of payment whereas a release of lien releases a previously recorded document.

“Should I Sign This Waiver?”

The two main things to check when you are asked to sign a waiver: 1. Is it a partial or final waiver? and 2. Is it a conditional or unconditional waiver?

1. Is it a partial or a final waiver?

- If it is a partial waiver, confirm that the dollar amount is correct. If the waiver includes a “paid through” date, be sure the dollar amount stated is correct for that time period.

- If it is a final waiver, confirm that payment of the amount stated includes everything billed or to be billed, that remains owed, on that project.

2. Is it a conditional or an unconditional waiver?

- The preferred waiver is a conditional waiver, which will specify that the waiver is conditioned upon receipt and clearance of the payment amount. If the payment is not received or does not clear, the waiver will not apply.

- An unconditional waiver does not state the payment has to clear the bank. If you do not receive the promised payment, or the check bounces, your rights remain waived.

When in doubt, seek a legal opinion – signing the “wrong” document could eliminate your mechanic’s lien and bond claim rights.