In 1935, the federal government created the Miller Act statute, requiring prime contractors to obtain a payment bond on any United States Government contract over a certain threshold.

What Is the Purpose of the Miller Act?

This law affords great protection to those who provide labor or materials to the prime contractor or its subcontractors on federal projects. With payment bond requirements for prime contractors and the ability for claimants to enforce claims against the payment bond, it deters non-payment.

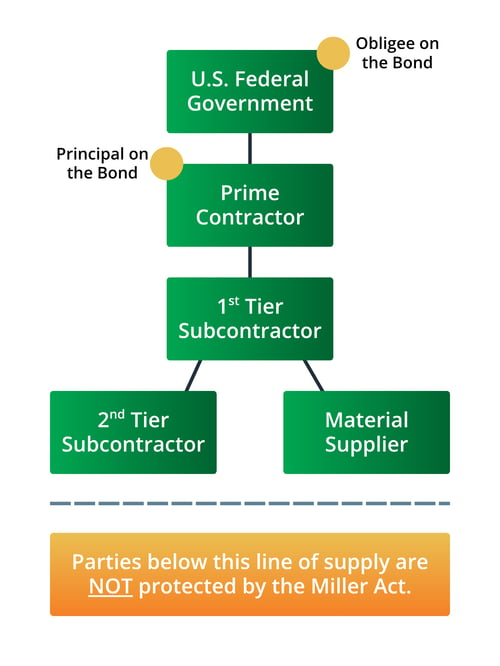

Who Is Protected by the Miller Act?

All those who provide labor and/or materials used in the prosecution of the work, to the prime contractor or first-tier subcontractor, are covered. Note: Those providing only materials to a material supplier are not protected by The Miller Act. Those furnishing to second-tier subcontractors are also too far removed to have rights under The Miller Act.

Can Miller Act Rights be Waived in a Contract?

Yes, rights can be waived. However, according to 3133. Rights of persons furnishing labor or material, the waiver must be in writing, and it can’t be executed until after the claimant has completed furnishing.

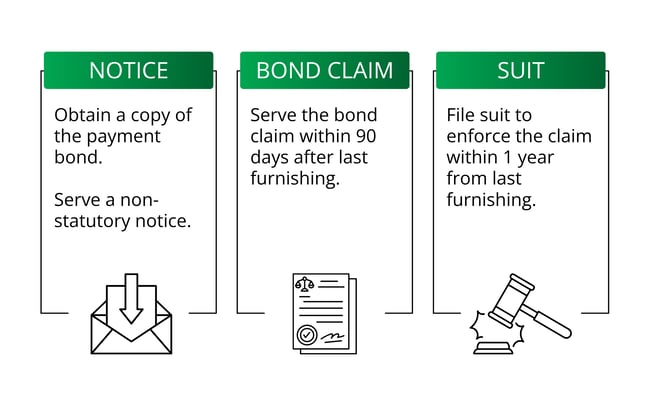

Miller Act Notice Requirements

No preliminary notice is required at the start of the federal project. However, a non-statutory notice is recommended so the prime contractor knows you will be protecting your rights.

How It Works for Claimants

For those who have furnished labor or materials to a federal project, and have not been paid, the bond claim should be served after your last furnishing, but within 90 days from your last furnishing. If serving the bond claim does not prompt payment, file suit to enforce the Miller Act Bond Claim in U.S. District Court after 90 days from last furnishing materials or services, but within 1 year from last furnishing materials or services.

What Is the Jurisdiction of the Miller Act?

The statute for federal projects is relatively straightforward and applies to all states; meaning unlike state statutes which vary, federal statute is the same across the board. U.S. Federal projects in foreign lands may also fall under the protection of the Miller Act.

Does the Miller Act Protect Projects on Tribal Land?

No, tribal land is sovereign and doesn’t fall under federal jurisdiction. We recommend proceeding with a non-statutory bond claim against the general contractor’s payment bond, along with pursuing the debtor (filing suit if necessary).

Another option could be the filing of a UCC-1. Of course, the UCC filing would need to be done before supplying materials to your customer, so that decision would have to be made at the time of contract.

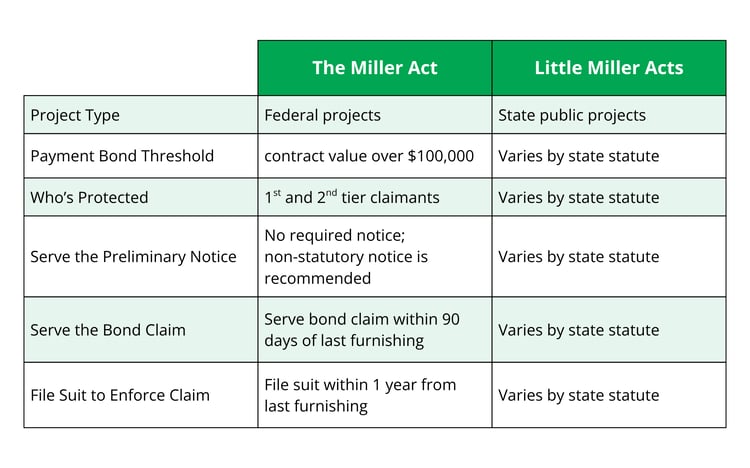

The Miller Act vs Little Miller Acts

The Miller Act is the federal statute that requires payment and performance bonds on certain federal construction projects. Every state has its own version (based on the Federal Miller Act), commonly called a “Little Miller Act.” While they serve the same purpose, protecting subcontractors, suppliers, and laborers on public projects where mechanic’s liens are not allowed, there are important differences.

The Federal Miller Act

- Applies to federal projects (contracts with the U.S. government).

- Requires payment and performance bonds on contracts over $100,000.

- Protects first and second-tier claimants (subcontractors and suppliers to the prime, or to a first-tier subcontractor).

- Bond Claim: Claimants must send written notice to the prime within 90 days of last furnishing labor or materials.

- Enforcement: suit must be filed within one year of last furnishing.

- The statute is uniform and applies consistently across the country.

Little Miller Acts by State

- Apply to state and local public projects.

- Bond thresholds vary by state. Some require bonds for nearly all projects, while others only require bonds above a set contract value.

- Who is protected depends on state statute. Some states limit claims to first tier parties, while others extend protection further down the chain.

- Notice requirements and deadlines differ by state. Some mirror the Miller Act, while others require additional preliminary notices or have shorter filing periods.

- Suit deadlines typically range from 6 months to 1 year, depending on the statute.

- Rules are not uniform, so each state must be reviewed individually.

(Note: a federally funded project doesn’t mean it’s a federal project.)

Provincial Construction Payment Rights in Canada

Discover your payment rights on provincial construction projects in Canada, including how to secure bond claim rights and navigate Public Works Act claims.

A Quick Guide to Mechanic's Lien Rights in Canada

Explore the essentials of securing mechanic's lien rights in Canada, including deadlines, notice requirements, and key provincial variations.

Know Your Customer. Protect Your Cash Flow in Any Economy.

Strengthen credit relationships by knowing your customer and using UCC filings & mechanic's liens. Learn how to protect your business in any economy.