Federal Construction Projects & The Miller Act Bond Claim

The Miller Act is the federal payment bond statute that requires general contractors to furnish payment bonds, on projects over a certain threshold, contracted by the United States.

A Wee Bit of History

In 1894, Congress passed the Heard Act, which was the first attempt by Congress to provide some form of payment security to unpaid subcontractors. Unfortunately, the Heard Act was a bit of a mess and it took several years for Congress to clean it up. Then in 1935, Congress passed the Miller Act. Although there have been some changes to the Miller Act since its inception, fundamentally the core remains unchanged.

The Miller Act requires prime contractors on federal projects to submit a payment bond to ensure payment for materials and services provided by their suppliers and subcontractors. Instead of filing a mechanic’s lien against a project, your right of recovery would be against the surety on the payment bond. The surety must be listed on the Treasury List and approved by the U.S. Department of Treasury.

The payment bond must be obtained by the prime contractor prior to being awarded a federal construction contract exceeding $100,000. To ensure the project you are working on is protected by The Miller Act, a copy of the payment bond should be requested at the beginning of the project.

What if the total original contract is for $100,000 or less?

If the federal construction contract is less than $100,000 but more than $25,000, the contracting officer and prime contractor must agree to a payment protection of:

- A payment bond

- An irrevocable letter of credit

- A tripartite escrow agreement (a federally insured financial institution distributes payments); or

- A certificate of deposit

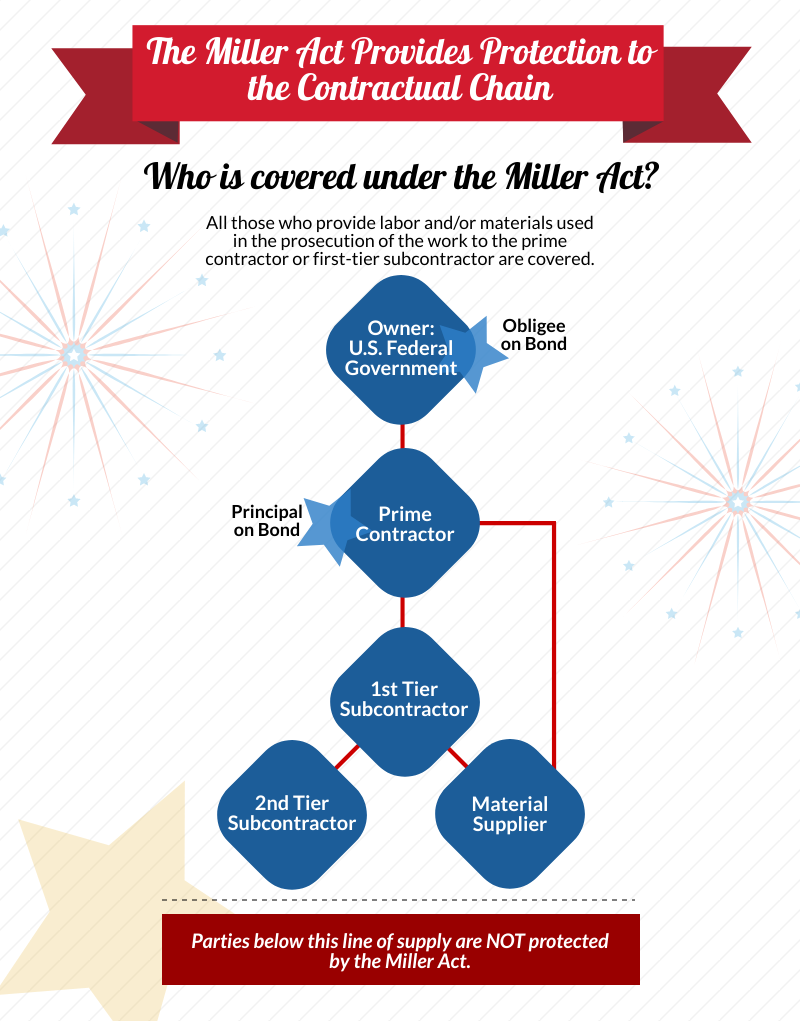

Who is covered under The Miller Act?

All those who provide labor and/or materials used in the prosecution of the work, to the prime contractor or first-tier subcontractor, are covered. Note: Those providing only materials to a material supplier are not protected by The Miller Act. Those furnishing to second-tier subcontractor are also too far removed to have rights under The Miller Act.

How is a claim made?

No preliminary notice is required at the start of the federal project. However, a non-statutory notice is recommended so the prime contractor knows you will be protecting your rights. Those furnishing to a subcontractor must serve their bond claim within 90 days from last furnishing materials or services.

In Pepper Burns Insulation, Inc. v. Artco Corp., it was upheld that the prime contractor must receive the claim by the deadline. If payment does not result from the notice of the bond claim, a suit to enforce the bond claim must be filed within one year from when materials or services were last furnished.

NOTE: There are some instances where a Miller Act payment bond may not be available. The bonding requirements on a federal project may be waived by the contracting officer in certain circumstances. The contract may be considered a supply contract rather than a construction contract. The federal government may also be funding a project where the fee owner is a private or public entity.