Arizona Preliminary Notice Changes Coming December 2019!

We are often asked, “Do I have to serve an amended notice if my contract amount increases?” and, “If so, how much does my contract have to increase to warrant another notice?” Generally, we recommend serving an amended notice when your contract amount increases by 20% or more. This recommendation is based on case law, attorney recommendations, and specific statute, e.g., Arizona.

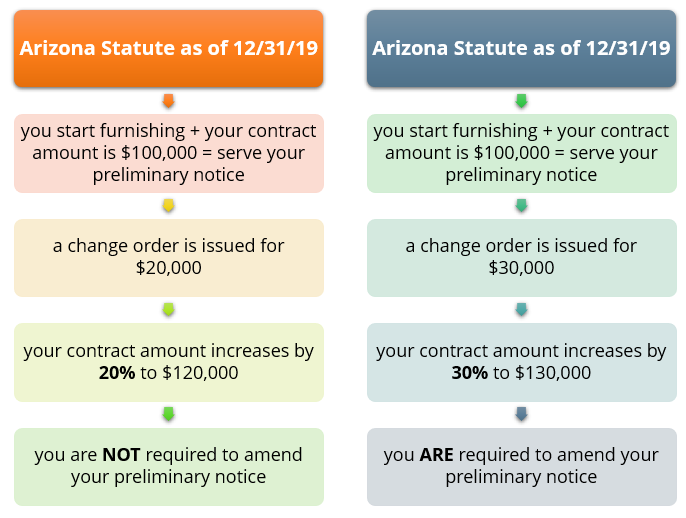

In fact, Arizona’s current statute specifically states a claimant only needs to serve one preliminary notice, unless its contract amount increases by 20% or more, then the claimant should amend its notice.

“A person required by this section to give notice…need give only one notice…unless the actual estimated total price for the labor, professional services, materials, machinery, fixtures or tools furnished or to be furnished exceeds by twenty per cent or more the total price in any prior original or subsequent preliminary notice…”

Soon “30″ Will Be the New “20″ in Arizona!

Earlier this month the Governor of Arizona signed HB1304 which updates the requirement for when an amended notice is required. For any projects where first furnishing occurs on or after 12/31/19, an amended notice will only be required if the contract amount increases by 30% or more.

“Effective for any projects where furnishings are first commenced to be furnished from and after 12-31-19, an additional notice will be required if the estimated total price for the furnishings exceeds by 30% or more the total price in a prior notice under the same contract.” – Legislative Update from The National Lien Digest

What Does This Mean for You?

Currently, under Arizona statute, if your original contract amount is $100,000 and a change order is issued increasing your contract to $120,000 (increased by 20%), you are required to serve an amended preliminary notice.

Here’s what it will look like at the end of December:

Once the new statute is in effect, you may notice a decrease in the number of required amended notices; saving you time & money.