What Is a Mechanic’s Lien?

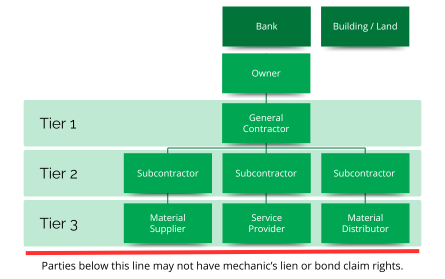

A mechanic’s lien (aka construction lien) is a lien against real property. A mechanic’s lien is often filed by a general contractor, subcontractor, or material supplier when they haven’t been paid for the materials or services furnished for a construction project. It’s a form of security used in the construction industry to recover payment.

Each state in the U.S., the U.S. Possessions and the Canadian provinces have laws in place to protect companies that furnish to the permanent improvement of a property. However, contractors, subcontractors, and suppliers must strictly adhere to the laws to properly secure their mechanic’s lien and bond claim rights.

Who Should File a Mechanic’s Lien?

Any party furnishing or supplying materials, equipment or services to a construction project should secure their mechanic’s lien rights. Mechanic’s liens can be filed by general contractors (aka prime contractors), subcontractors, material suppliers or material distributors.

Why You Should File a Mechanic’s Lien

You should file a mechanic’s lien to protect your right to get paid for the materials or services you provide to the improvement of real property (i.e., a construction project).

If you’ve completed work on a project but haven’t been paid, filing a mechanic’s lien is one of the most effective ways to secure your payment. Property owners and contractors take payment obligations more seriously when they know a mechanic’s lien is involved, as it can create delays or complications for them. In many cases, simply filing or threatening to file a lien is enough to prompt payment.

Most importantly, a mechanic’s lien protects your financial interests. If your customer (or any party in the ladder of supply) goes bankrupt or refuses to pay, a properly filed mechanic’s lien strengthens your legal position and increases the likelihood of recovering what you’re owed. By filing a mechanic’s lien, you are ensuring you’re paid for the work you’ve completed.

How Mechanic’s Liens Can Help You Save

- Payment Security: Properly served preliminary notices and filed mechanic’s liens protect your right to payment by establishing legal claims against the property. This ensures you get paid for your work.

- Keeping Projects on Track: The threat of mechanic’s liens and litigation creates urgency for property owners, motivating them to prioritize payments and keep the project moving forward.

- Protection Against Bankruptcy: If a project owner files for bankruptcy, a mechanic’s lien secures your legal right to payment, protecting contractors, subcontractors, and material suppliers from financial loss.

- Reduce Legal Costs: Properly filing mechanic’s liens can save businesses substantial legal fees by avoiding costly litigation over unpaid work.

- Leverage in Payment Disputes: Preliminary notices & mechanic’s liens provide you with strong negotiating power; ensuring there are no excuses for non-payment and increasing the likelihood of being paid on time.

How Do You Secure Mechanic’s Lien Rights?

The mechanic’s lien process is comprised of three parts: preliminary notice, mechanic’s lien (or bond claim), and foreclosure or suit to enforce the claim.

What Is a Preliminary Notice?

The first step to secure mechanic’s lien rights on a private project (or bond claim rights on a public project) is to serve a preliminary notice. A preliminary notice is not a mechanic’s lien, it’s a prerequisite to filing a mechanic’s lien and identifies you as a party furnishing materials or services to a construction project.

Statutory preliminary notices are governed by state law and typically must be served upon the general contractor and/or project owner within the specified timeframe. However, it’s recommended you serve the notice upon all parties within the ladder of supply to increase transparency and prioritize your payment.

If you don’t serve the preliminary notice, and the notice is required, you could invalidate your right to file a mechanic’s lien on the project. Currently, 43 states in the U.S. and one province in Canada have provisions for a preliminary notice to be served prior to filing the lien. Furnishing to a project in a state where no preliminary notice is required? Consider serving a non-statutory notice.

- Statutory Preliminary Notice: a statutory preliminary notice is a notice created by a state’s law. This notice is often served upon the owner and/or prime contractor as a precondition to filing a lien or serving a bond claim.

- Non-Statutory Preliminary Notice: a non-statutory notice is a notice (not created by state law) served upon parties on the ladder of supply, advising all parties that you are furnishing to a project.

A preliminary notice goes by different names depending on the state in which it’s served. Some alternative names include notice to contractor, notice to owner, notice of furnishing and prelien notice.

The Mechanic’s Lien

Step two is to file a mechanic’s lien. The lien must be filed within a specific time frame and the deadline is frequently calculated from your last furnishing date or the date of project completion.

Suit to Enforce a Mechanic’s Lien Claim or Foreclosure

The final step is enforcing your claim. A suit, or lawsuit, is an action in a court of law to enforce a claim. Is this the same as foreclosure? Foreclosure is a legal action to enforce a lien against real property with the purpose of having the property sold to satisfy the lien. Suit may lead to foreclosure. It has been our experience that suit does not usually result in foreclosure/sale of the property; more often, during the suit phase, settlement agreements are reached without the need for sale of the property.

How Do Mechanic’s Liens Work?

When a contractor, subcontractor, or material supplier completes work on a property but is not paid, they can file a mechanic’s lien as a legal claim for the unpaid amount. This lien becomes an encumbrance that clouds the title, making it difficult to sell or refinance the property. A title search will reveal any liens, alerting potential buyers to the issue. Because buyers typically do not want to take on responsibility for unpaid debts, they often require the lien to be satisfied (meaning the contractor, subcontractor, or supplier must be paid) before completing the purchase. If the property owner cannot pay the debt, the contractor has the right to foreclose on the property, forcing a sale to recover the money owed.

What Are the Deadlines?

How long do you have to file a mechanic’s lien? Mechanic’s lien deadlines vary by state, though they are often calculated from the date of last furnishing or project completion. Once you have confirmed the deadline, don’t wait until the last minute to file the lien. Various factors (inclement weather, county closures, state holidays and the wait-times for document recording, etc.) can cause major delays in recording. When unforeseen circumstances arise, other methods of service may be required, which can be costly.

Notice of Lien Requirements

The mechanic’s lien should be recorded with the appropriate recording office and, as a best practice, a copy should be served upon all parties in the ladder of supply.

For example, in California, the mechanic’s lien:

“verified and containing the information required in subdivision (a), shall be accepted by the recorder for recording and shall be deemed duly recorded without acknowledgment.” Further, “…(c) A copy of the claim of mechanics lien, which includes the Notice of Mechanics Lien required by paragraph (8) of subdivision (a), shall be served on the owner or reputed owner… (2) If the owner or reputed owner cannot be served by this method, then the copy of the claim of mechanics lien may be given by registered mail, certified mail, or first-class mail, evidenced by a certificate of mailing, postage prepaid, addressed to the construction lender or to the original contractor.” – CA Civ. Code 8416

Who Should Receive the Mechanic’s Lien?

Generally, the lien should be served upon the owner and general contractor; however, it is recommended to serve a copy on all parties involved. The more people that know you haven’t been paid the more pressure they will put on the appropriate party to encourage payment.

Florida’s mechanic’s lien statute 713.08(4)(c) states:

“The claim of lien shall be served on the owner. Failure to serve any claim of lien in the manner provided in s. 713.18 before recording or within 15 days after recording shall render the claim of lien voidable to the extent that the failure or delay is shown to have been prejudicial to any person entitled to rely on the service.”

Nevada’s statute identifies the owner as a required party and, if you are a subcontractor, you must serve a copy upon the prime contractor:

“1. In addition to the requirements of NRS 108.226, a copy of the notice of lien must be served upon the owner of the property within 30 days after recording the notice of lien… 3. Each subcontractor who participates in the construction, improvement, alteration or repair of a work of improvement shall deliver a copy of each notice of lien required by NRS 108.226 to the prime contractor. The failure of a subcontractor to deliver the notice to the prime contractor is a ground for disciplinary proceedings pursuant to chapter 624 of NRS.” – NRS 108.227

How Is a Mechanic’s Lien Enforced?

A mechanic’s lien is enforced through litigation. A suit, or lawsuit, is an action in a court of law to enforce a claim. Is this the same as foreclosure? Foreclosure is a legal action to enforce a lien against real property with the purpose of having the property sold to satisfy the lien.

Suit may lead to foreclosure. During litigation, it may come to light that debts can only be paid if the property is sold & the proceeds are then used to square up the debts.

Please understand, it has been our experience that suit does not usually result in foreclosure/sale of the property; more often, during the suit phase, settlement agreements are reached without the need for sale of the property.

Lien Enforcement Deadlines

Suit to enforce the mechanic’s lien must be filed within the timeframe outlined by each state’s statute. In Georgia (O.C.G.A. § 44-14-367), suit must be filed within 365 days from filing the lien, or within 60 days from a Notice of Contest of Lien served by the owner. Whereas, in Ohio (ORC Sec. 1311.01-1311.21) you must file suit to enforce the lien within 6 years from filing the lien, and within 60 days of being served with a notice to commence suit.

It’s important to note, you must file suit by the deadline, but you don’t have to wait until the deadline to file suit (e.g., in Ohio, you must file suit within 6 years but you don’t have to wait 6 years).

Lien Enforcement Challenges

Lien enforcement challenges could widely vary, but may include complex property ownership (including lien on leasehold situations), issues of priority, back charges/change orders or disputes, and failure to strictly comply with statutory requirements.

Priority Issues

If there are multiple mechanic’s liens filed on a given property, issues of priority may arise. The determination of priority is up to arbitration or the court, though some state laws do outline who priority.

If we refer to Florida’s statute, F.S. Title 40, Section 713.07, it reads in part:

“(1) Liens… shall attach at the time of recordation of the claim of lien and shall take priority as of that time. (2) Liens… shall attach and take priority as of the time of recordation of the notice of commencement, but in the event a notice of commencement is not filed, then such liens shall attach and take priority as of the time the claim of lien is recorded.”

Are there Limitations?

Limitations may include whether the lien is being filed in a full balance or unpaid balance lien state. In a Full Balance Lien state, the lien is generally enforceable for the full amount owed, regardless of payments made by the owner.

In an Unpaid Balance Lien state, the lien is limited to the unpaid portion of the general contract. An Unpaid Balance Lien state protects the owner from having to pay twice for materials and labor provided to their construction project.

Nebraska is an Unpaid Balance Lien state.

52-136 (2) Except as modified by subsections (4) and (5) of this section, as against a protected party contracting owner, the lien of a claimant other than a prime contractor is for … (b) The amount unpaid under the prime contract through which the claimant claims at the time the contracting owner receives the claimant’s notice of the right to assert a lien.

An example: Let’s say the general contract was for $100,000. The owner has paid the general contractor (aka “prime contractor”) $75,000. This leaves only $25,000 for liens filed by other parties on the project — even if those parties are owed more than $25,000.

When your lien is limited to the unpaid portion of the general contract, it is critical you file the lien as soon as possible, so it is filed prior to the owner paying the prime contractor.

Limited Recovery

Recovery may be limited by many factors. Depending on the state, you may be unable to recover legal fees (recovery would be limited to the value of materials or services provided to the construction project). In some cases, the owner and/or GC may have insufficient funds to cover all debts, and you may only recover a pro-rata share.

What Happens to the Mechanic’s Lien When I Receive Payment?

When you have filed a mechanic’s lien and then receive payment for the outstanding debt, you must file a release of lien. A release of lien is a document recorded upon satisfaction of a claim of lien. When a lien is filed, it becomes public record and encumbers the property. Unless a release of lien is filed, the public record will continue to reflect the lien, and it will appear as an encumbrance.

As best practice, prior to releasing the lien you should confirm you have received payment in full and the payment has cleared. If you release the lien and an issue arises with payment, you may not be able to refile the lien.

What Is a Lien Waiver?

A lien waiver is a signed document in which the would-be lien claimant agrees to waive rights to its claim based on payment received. Lien waivers are either conditional or unconditional and partial or final.

- A conditional lien waiver is conditioned up receipt and clearance of the payment. If the terms of a conditional lien waiver aren’t met, the waiver becomes null and void. For example, if you don’t receive payment or the payment doesn’t clear the bank, you have a right to file a mechanic’s lien to recover the payment.

- An unconditional lien waiver is not conditioned upon receipt and clearance of payment. Without conditions, you lose leverage. If you don’t receive payment or the payment doesn’t clear the bank, you’re unable to file a mechanic’s lien because you waived your right to file the mechanic’s lien.

Conditional lien waivers are preferred over unconditional lien waivers, because the “conditions” provide the creditor with leverage, in the event payment is not received or does not clear.

The Value of Commercial Credit Collection Services and Construction Attorneys

Mechanic’s liens are powerful, and the power lies in the details. The nuances (deadlines!) and complexities of each state’s statute make the mechanic’s lien process cumbersome and time consuming. Save time, money, and frustration by partnering with mechanic’s lien experts.

Whether you have a mechanic’s lien process in place or are just starting to explore the benefits of mechanic’s liens, NCS Credit is ready to develop and manage the process for you. The mechanic’s lien process, including preliminary notices, mechanic’s liens, bond claims, and foreclosure, is our specialty. We are uniquely positioned to provide you with a comprehensive mechanic’s lien program.

In addition to our in-house mechanic’s lien experts, we maintain a strong national network of construction attorneys. These attorneys specialize in mechanic’s lien enforcement and construction litigation.

NCS Credit is the industry’s only full-service provider of mechanic’s lien, UCC filing, and commercial collection services. Powered by our knowledgeable staff and fueled by technology, we will simplify your process and deliver a best-in-class experience. With unparalleled industry expertise, we understand the complexities of commercial construction credit.