Payment Clauses: Pay-IF-Paid or Pay-WHEN-Paid

It’s hard to believe that two small words, with seemingly “useless, yet endless” functionality, can cause such a flurry of confusion and chaos. Though it’s true – “if” and “when” are two words that, if and when they are incorporated into a contract, could determine whether or not a subcontractor is paid, regardless of services provided.

Both pay-if-paid and pay-when-paid are considered contingent payment clauses. According to the American Subcontractors Association, Inc. a contingent payment clause is

“…a contractual provision that makes payment contingent upon the happening of some event. In construction subcontracts, the typical contingent payment clause makes the subcontractor’s payment contingent upon the payment of the contractor by the owner.”

Before we get too far, let me clarify one thing: when it comes to contingent payment clauses, no two states are alike in their interpretation of these clauses – attorneys and courts throughout the U.S. provide differing opinions, decisions and enforcements.

What is Pay-If-Paid?

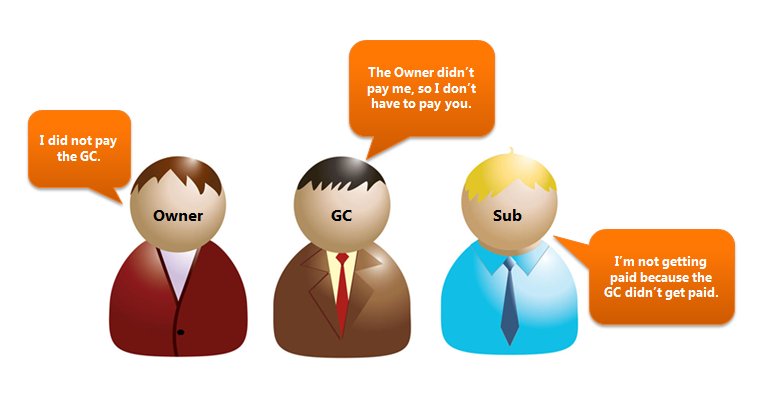

Pay-if-paid is generally interpreted to mean that the subcontractor will receive payment from the GC if the GC is paid by the owner. The Public Contracting Institute states that pay-if-paid makes the “owner’s payment to the prime a “condition precedent” for the prime’s payment to its subs.”

Note: Many states will not honor pay-if-paid unless the language in the agreement clearly states that payment by the owner is a condition precedent to you being paid.

So, for example, if the owner files for bankruptcy protection and does not pay the GC, then the GC is not obligated to pay the Sub.

What is Pay-When-Paid?

Pay-when-paid is generally interpreted to mean that the subcontractor will receive payment from the GC when (or after/once) the GC receives payment from the owner. Typically this clause includes a timeframe in which the sub will be paid:

“Once the owner remits payment to Mr. GC, Mr. GC will wait 10 days and on the 11th day, Mr. GC will pay Mr. Sub”

The Public Contracting Institute advises that pay-when-paid is viewed more as a “timing provision” – i.e. the GC has to pay the Sub within a reasonable amount of time from when the sub invoices.

Which Clause is Better?

A pay-when-paid clause is much better than a pay-if-paid clause, as the general contractor is not relieved of the responsibility to pay his subcontractors if he is not paid. However, payment clauses can be tricky and you should seek a legal opinion if your contract has a clause you are uncomfortable with.

“IF” and “WHEN”

Regardless of “if” and “when” clauses, make sure you review your contract carefully to ensure you are able to secure your mechanic’s lien or bond claim rights.