Bankruptcy Payout Priority – Secured Creditors Make Bank

As a credit professional, you’ve likely heard this once or twice: “It’s better to be a secured creditor than an unsecured creditor.” After all, credit is how the majority of us do business in today’s economy and, as credit professionals, we want to insure we are paid for the goods & services we provide.

I often hear secured-credit-skeptics say “If my customer files bankruptcy, I won’t see a dime, why waste my money on a UCC or lien” or “Once the courts get paid, there won’t be anything left for me” and, my favorite, “My customer and I have a great relationship, they’ll never fail & I will always get paid.”

“If I file a UCC Financing Statement is it a guarantee that I will get paid?”

As with everything in life, there are no guarantees – with the exception of death and taxes. No, you are not guaranteed to be paid in the event your customer files bankruptcy; however a perfected UCC filing will make you a secured creditor, which would put you in the best possible position to get paid.

“If a company files bankruptcy, which creditors get paid first?”

The bankruptcy code is specific, detailed and, well…it’s long – but here is the basic payout priority:

Payout Priority in Chapter 11 Bankruptcy

- Secured Creditors (i.e. creditors who have a perfected security interest)

- Administrative Expenses (i.e. costs associated with filing & processing the bankruptcy)

- Unsecured Creditors (i.e. creditors without a security interest)

“Do creditors really get paid?”

Yes, creditors really do get paid – although every bankruptcy exit plan is different. Let’s take a look at a few bankruptcy cases, which demonstrate the immense benefit of being a secured creditor rather than an unsecured creditor.

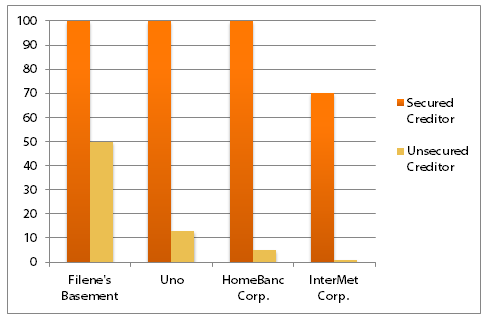

- Filene’s Basement “Secured creditors have been paid in full, holders of priority claims and convenience class claims have received 100% of their allowed claims, and unsecured creditors have been paid 50% of their allowed claims.”

- Uno “The plan gives the holders of $142 million of senior secured debt 100 percent of the stock in the new company. Unsecured creditors who sell their claims will receive about 13 percent.”

- HomeBanc Corp. “The accompanying disclosure statement says that unsecured creditors with $223.5 million in claims would recover between 1 percent and 10 percent. Secured creditors with claims of $69.6 million would be paid fully.”

- Intermet Corp. “The disclosure statement says first-lien creditors should expect a 70 percent recovery while second-lien term loan lenders, owed $107 million, and unsecured creditors with $93 million in claims, could realize around 1 percent.”

Although there are no guarantees, time and time again we see secured creditors receiving more funds than unsecured creditors.

The information presented here illustrates that secured creditors are in the best possible position to get paid. However, this assessment does not guarantee a payout in future bankruptcies.