“Pay-If-Paid” Leaves Subcontractor High and Dry

An Alabama Court of Appeals has upheld a trial court’s decision: a subcontractor cannot recover its claim from the general contractor’s surety if the subcontract contains a contingent payment clause (pay IF paid). In today’s post I’ll discuss securing bond claim rights in Alabama, explain contingent payment causes, and review a recent Alabama Court of Appeals’ case.

Securing Bond Claim Rights in Alabama

For public projects in Alabama, payment bonds are typically required if the general contract is $50,000 or more. As a best practice, you should always attempt to obtain a copy of the payment bond when you agree to a contract or purchase order.

You are not required to serve a preliminary notice, but it’s a good idea to serve a non-statutory notice to alert parties within the ladder of supply that you are furnishing to the project.

If you furnish to the project and are not paid, you would serve a bond claim notice upon the surety no later than 45 days prior to filing suit. Then, you would file suit to enforce the bond claim after 45 days from serving the bond claim notice, but within 1 year from the date of final settlement. [Ala. Code 39-1-1]

IF and WHEN: Contingent Payment Clauses… if & when…

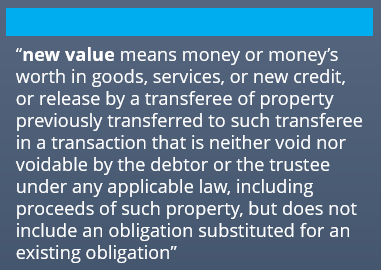

How quickly two small words can create a payment mess! Pay-if-paid is generally interpreted to mean that the subcontractor will receive payment from the general contractor IF the general contractor is paid by the owner. Whereas, pay-when-paid is interpreted to mean the subcontract will receive payment from the general contractor WHEN (or after/once) the general contractor receives payment from the owner.

The “IF” clause is also known as condition precedent. Payment to the subcontractor is dependent on payment made to the general contractor by the owner.

The “WHEN” clause is viewed more as a timing provision. The general contractor will pay the subcontractor within a reasonable amount of time from when the subcontractor issues its invoices. Payment under this clause is not reliant on the owner paying the general contractor.

Pay-when-paid is more desirable than pay-if-paid, because the general contractor is not relieved of paying its subcontractors under pay-when-paid.

Subcontractor Can’t Recover Claims from Surety

Keller Construction Company v. Harford Fire Insurance Company

- Subcontractor & claimant: Keller Construction Company (Keller)

- General Contractor & payment bond obligor: J.F. Pate & Associates Contractors, Inc. (Pate)

- Owner & payment bond obligee: City of Spanish Fort (City)

- Surety: Hartford Fire Insurance Company (Hartford)

City hired Pate, and Pate obtained a payment bond from Hartford. Pate hired Keller and the parties executed a subcontract. Under the terms of the subcontract, Pate could withhold retainage from Keller for the same retainage amount City withholds from Pate. Also, under the terms of the subcontract, Keller assumes the risks associated with the City not paying Pate.

Language from the subcontract, in part:

“[T]he receipt by [Pate] of payment from [the city] for the work performed by [Keller Construction] is a condition precedent to the obligation of [Pate] to pay [Keller Construction]. [Keller Construction] further acknowledges that it is assuming the risk of delay in payment or non-payment by the [city] to [Pate]. Both the condition precedent for payment and the assumption of this risk are bargained for considerations in this agreement, without which [Pate] would not have entered into this agreement with [Keller Construction].”

The words “condition precedent” are right there in the contractual language. Not only that, but the language clearly indicates that Keller is aware of and is assuming any of the payment risk. The Court’s opinion states Keller was fully aware of the conditions of the contract and understood the provisions.

Keller completed its work and Pate had remitted payment to Keller except for the retainage amount. Why? Because City did not pay Pate the retainage or the withheld funds. And according to the subcontract, if Pate was not paid by the owner, Pate did not have to pay Keller.

Keller proceeded with a bond claim and Hartford denied Keller’s claim. Hartford claimed it was not obligated to pay Keller, because the surety is only obligated to pay what the general contractor was obligated to pay. In this case, the general contractor wasn’t obligated to pay retainage, because it hadn’t been paid retainage, thus, relieving the surety of any payment obligation.

Keller tried several arguments, all of which failed, including conflicting language within the terms of the payment bond and the terms of the subcontract.

It got a bit muddy, but the gist is the court determined the two contracts (payment bond and subcontract) need to be treated separately as they fall under separate laws. Essentially, you can use payment bond language to override subcontract language.

Takeaway

Payment provisions are often strictly interpreted. If you enter into a contract, make sure you understand the terms of the contract and know that if you execute the contract you are committing to the terms. When reviewing the contract, it’s a good idea to have a legal professional also review, specifically to look for clauses that may jeopardize payment.