Always ask yourself these two questions before you release a mechanic’s lien

What is a Release of Lien?

“A release of lien is a document recorded upon the satisfaction of a claim of lien. Statutory penalties may be incurred if a lien is not released upon satisfaction”

What should I know before releasing a lien?

Once you have made the decision to file a mechanic’s lien, the next decision you will need to make is when to release the mechanic’s lien. Before you rush to release your security, you should ask yourself:

“Have I been paid in full? Has the payment cleared?”

Too obvious? Perhaps, but if you can answer “yes” to both of these questions, you should feel confident that it is safe to release the mechanic’s lien.

If you have not been paid in full and/or the payment has not cleared, you should be very cautious. Think of the proverbial “Do not pass go, do not collect $200.” If you release the mechanic’s lien, and you have not received/cleared full payment, you may forfeit your security and subsequent recourse on unpaid funds.

I’ve been paid; do I have to release the lien right away?

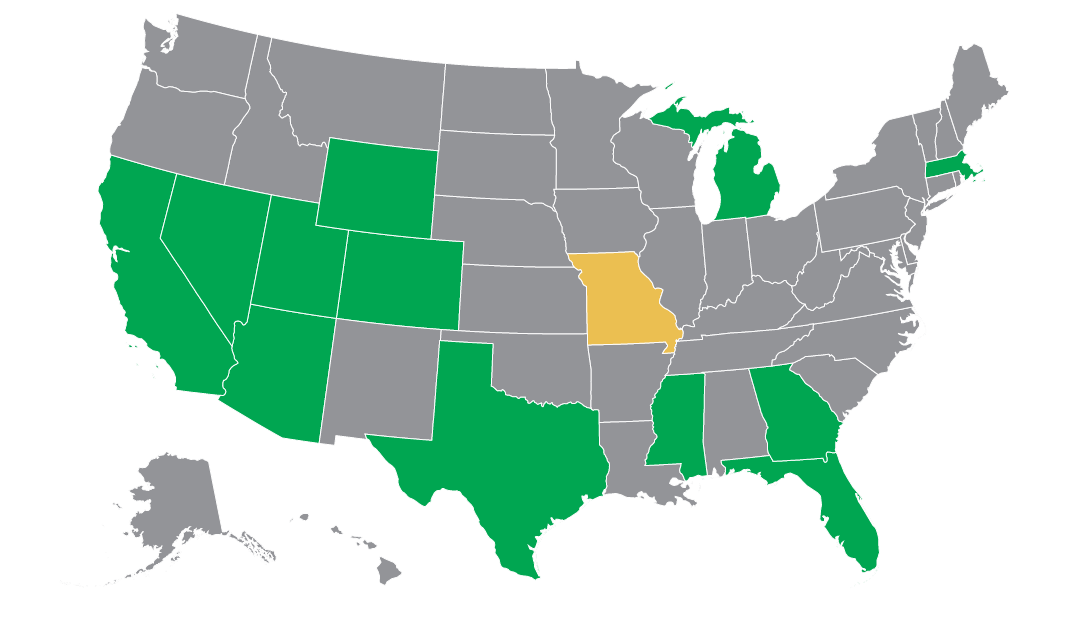

Some states have a specific time frame described in their statute (i.e. in Arizona, the lien must be released within 20 days from satisfaction), but a good rule of thumb is to promptly release the lien once the lien has been satisfied. Not only is a timely release of the satisfied lien required by law, it is also a respectful business practice.

Do I have release options?

In some states you can file a partial release of lien. A partial release of lien is just what it sounds like – you are releasing a portion of the original mechanic’s lien, as opposed to the full amount of the mechanic’s lien. For example: you filed a lien for $100,000 and your customer has paid you $25,000; you could file a release for the $25,000 and the lien will remain in place for the balance of $75,000.

Make sure you consult an attorney before proceeding with a partial release. You want to make sure you are adhering to statute and not forfeiting your lien rights.

What if I haven’t been paid, but my customer agrees to pay me if I release the lien?

Your customer doesn’t want to pay until the lien is released, and you don’t want to release the lien until you are paid. It is not uncommon to Exchange a Release of Lien for payment.

Essentially, you will give your customer the executed (but not recorded) release of lien and your customer will give you payment in certified funds. Then, you can deposit the payment and your customer can record the release of lien.

Best Practice

Though an exchange is fairly common, it may not hurt to have an intermediary – just to help keep everyone honest.