Navigating Credit Trends in 2025: Embracing Technologies and Economic Shifts

Happy New Year! With a new year comes new opportunities and, of course, new challenges. Credit management is preparing for significant transformation this year. Rapid advancements in technology, shifting regulatory landscapes, and changing economic policies are reshaping the way businesses assess and manage credit risk. For companies looking to stay ahead of the curve, understanding these developments will be key to minimizing credit risk and maximizing profitability.

The Role of AI in Credit Management

Artificial intelligence (AI) is revolutionizing credit management by providing businesses with powerful tools to streamline processes, assess credit risk more accurately, and enhance decision-making.

AI’s ability to process vast amounts of data, identify patterns, and predict future trends is helping companies move from reactive to proactive credit management strategies.

- Automated Credit Scoring: By analyzing alternative data sources such as payment histories, social media activity, and even behavioral data, AI algorithms can create more accurate credit profiles, reducing the risk of defaults.

- Risk Prediction Models: Machine learning models are increasingly being used to forecast potential credit defaults, helping businesses identify high-risk clients and adjust payment terms accordingly.

- Fraud Detection: AI’s capabilities in anomaly detection are being applied to credit card transactions and loan applications, making it easier to spot fraud and mitigate financial losses.

As with any technology, it’s important to note AI is still relatively new and certainly not without flaws. Evaluating and managing credit still needs humans – Credit Heroes. Credit Heroes have much more experience with nuances of business credit and the business relationship itself. You will remain vital in credit management.

Shifts in Regulatory Landscape and Its Impact on Credit Risk

The regulatory environment surrounding credit is evolving rapidly, with new policies and guidelines shaping how businesses manage credit risk and report financial data.

Keep an eye on Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance. Financial institutions and businesses are under increasing pressure to meet AML and KYC standards. Regulatory bodies are enforcing stricter compliance, requiring businesses to implement more sophisticated systems for verifying the identities of customers and monitoring transactions.

Economic Policies and Their Effect on Payment Terms and Liquidity

Economic policies, including interest rates, fiscal measures, and inflation control strategies, will play a significant role in shaping business credit practices.

Some trends to monitor this year include:

- Interest Rate Movements: Central banks around the world are adjusting interest rates in response to inflation and economic growth patterns. Higher interest rates can increase the cost of borrowing, making it more expensive for businesses to extend credit to customers. Companies may need to adjust their payment terms or credit policies to mitigate the impact of higher borrowing costs.

- Inflation and Payment Delays: Inflation, particularly in the wake of global economic uncertainty, may lead to longer payment cycles as businesses struggle with rising costs and cash flow constraints. Companies should implement secured transactions (UCC filings and mechanic’s lien processes) to improve cash flow and working capital.

- Government Stimulus and Support Programs: Some economies may introduce stimulus programs or financial relief measures to support businesses during downturns. These programs can impact payment terms and credit risk as businesses navigate periods of economic volatility.

Filing UCCs and Protecting Mechanic’s Lien Rights

As businesses face evolving credit challenges, protecting financial interests through strategic secured transactions is critical, especially in industries like construction, manufacturing, and distribution where physical goods and services are exchanged. Fortunately, UCC filings and mechanic’s liens are our areas of expertise!

Filing UCCs (Uniform Commercial Code filings) and securing mechanic’s lien rights are essential to protect against nonpayment and aid in the collection of outstanding debts.

UCC Filings: Securing Interests in Personal Property

A UCC filing, also known as a UCC Financing Statement or UCC-1, is a document filed with the Secretary of the State which serves as public notice of a creditor’s security interest in certain collateral owned by their customer.

UCCs should be filed by any business that extends credit to its customers. If you sell goods or services on credit, you should file a UCC-1 Financing Statement to establish your interest in the goods provided. Then, in the event of nonpayment, you have the right to repossess your inventory or equipment.

Mechanic’s Lien Rights: Protecting Contractors and Suppliers

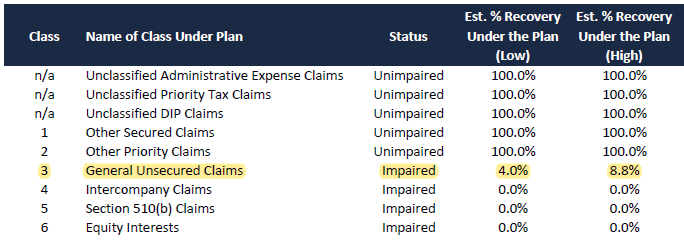

For construction-related businesses, mechanic’s liens are a powerful legal tool to ensure payment for work completed or materials supplied. Typically, a mechanic’s lien can be filed by contractors, subcontractors, suppliers, or other parties involved in the construction process to protect their right to payment.

A mechanic’s lien places a legal claim on a property until the debt owed for labor, services, or materials is paid. In the case of nonpayment, the lien can be enforced by forcing the sale of the property to recover the outstanding balance.

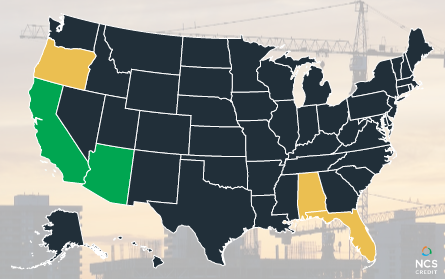

Each state has different rules and deadlines for filing a mechanic’s lien, but most require that the lien be filed within a specific time frame after the work is completed or materials are delivered. Failure to file within the window can result in losing the right to enforce the lien.

Both UCC filings and mechanic’s liens provide crucial protection for businesses in high-risk industries.

Credit Management in 2025 and Beyond

The credit landscape will be shaped by technological innovations, regulatory changes, and evolving economic policies. To stay competitive, you must adopt forward-thinking credit management strategies, maintain compliance with changing regulations, and remain adaptable to economic shifts. Additionally, using legal tools such as UCC filings and mechanic’s liens will be critical to minimize credit risk and maximize profitability.

- Invest in Credit Tech Solutions: Embracing technology, such as AI-driven credit risk assessment tools, will be critical for businesses looking to stay competitive.

- Strengthen Data Analytics Capabilities: Companies that leverage data analytics and machine learning to predict trends, optimize credit terms, and reduce risk will be well-positioned to succeed.

- File UCCs and Mechanic’s Liens: In an uncertain economic climate, businesses must protect receivables, inventory and equipment. UCC filings and mechanic’s liens are legal tools proven to get you paid.

NCS Credit, Your Credit Ally

Every Credit Hero needs a Credit Ally! We are the industry’s only B2B full-service provider of UCC filings, mechanic’s liens and commercial collections. With unparalleled industry expertise, we understand the complexities of commercial credit.

NCS Credit’s Online Services is built for the busy credit professional, empowering you to quickly, efficiently and accurately protect your receivables in an easy-to-use central system. With a single login you have access to a powerful platform to manage collection placements, UCC filings, notices & mechanic’s liens, lien waivers and more!

Powered by our knowledgeable staff and fueled by technology, we will simplify your current process and deliver a best-in-class client experience. Contact us today to learn more!