Can Your UCC Filing be Revived if You Knowingly Let It Become Unperfected?

Can a UCC be “revived” if you knowingly fail to timely file an amendment for a debtor’s name change? Minnesota Bankruptcy Court says no. Today’s post reviews an ongoing case of an unperfected security interest & the persistent unsecured creditor lobbying for secured status.

Short on time? Here’s a quick synopsis from the court decision:

“When Unger Meat Company became Rancher’s Legacy Meat Co. in May 2014, Ratcliff had four months within which to correct his UCC-1 Financing Statement to reflect this change. When he failed to do so, by operation of the plain language of the UCC, as adopted in Minnesota, his lien became unperfected in September 2014. Although Ratcliff could have re-perfected his interest at any time by filing a new UCC-1 Financing Statement, he failed to do that as well. Instead, he filed two UCC-3 statements — a Continuation Statement in November 2015 and an Amendment to that Continuation Statement in January 2019. Basic rules of statutory construction prevent these documents — even when taken together as a whole — from serving as a substitute for the UCC-1 Financing Statement required to re-perfect the interest. Therefore, when this chapter 11 case was filed in September 2019, Ratcliff’s interests were unperfected; he had the status of an unsecured creditor. As such, he is not entitled to adequate protection payments or relief from the automatic stay, and his liens can be avoided for the benefit of the broader bankruptcy estate.”

The Tale of the Unperfected UCC Filing

In 2010, James Ratcliff (Ratcliff) & Joseph Unger started Unger Meat Company (UMC). Ratcliff purchased the building to be used by UMC and leased the building to UMC. Ratcliff and UMC entered into a Security Agreement, which granted Ratcliff a security interest in “all of the Debtor’s equipment, including but not limited to the equipment described on Exhibit “1” hereto, inventory, lease agreement, accounts receivable, furniture and fixtures, whether now owned or hereafter acquired, together with all proceeds and products thereof and replacements therefor.” In 2010, Ratcliff filed a UCC-1 to perfect the security interest and later filed a UCC-3 (amendment) in early 2011.

Early 2014, after UMC had spent years losing money, Ratcliff and the other original owners agreed to sell the company to SSJR, LLC. A new purchase agreement was executed, and the agreement identified SSJR, LLC as the sole purchaser of Ratcliff’s shares in UMC. After the sale was finalized, SSJR, LLC amended the Articles of Incorporation for UMC, changing the company name to Rancher’s Legacy Meat Company (RLMC).

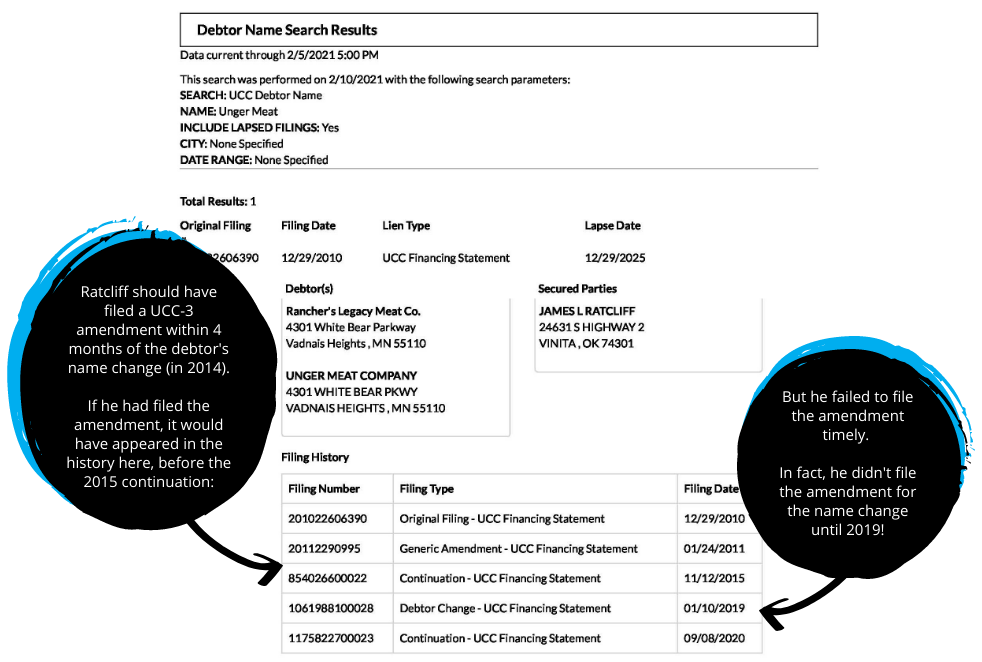

Although Ratcliff was aware of the company name change, he did not file an amendment and four months after the name change, his security interest became unperfected. Remember, Article 9-507(c)? Article 9-507(c) provides a 4-month window to amend the filing for a debtor name change that may be considered seriously misleading. Guess what? A search on “Rancher’s Legacy Meat Company” is not going to reveal a UCC filed on “Unger Meat Company.” You know what that means: seriously misleading.

In 2015, 5 years after Ratcliff originally filed his UCC-1, he filed a continuation. Two problems with this continuation? Well, the first is he no longer had a perfected security interest because he didn’t amend his filing when the debtor name changed. The second problem is that even if Ratcliff had properly filed an amendment, he filed this continuation on the wrong debtor name; he filed the continuation listing the name as UMC, not RLMC.

Fast Forward to an Amendment with the Correct Name

Fast forward to 2019, nearly 10 years from the original filing and 5 years from the time he should have amended his filing with the correct debtor name, and 1 year from the alleged continuation filing, Ratcliff filed another amendment and this time he listed the debtor’s name as “Ranger’s Legacy Meat Co.” What is this, three wrongs make a right? I don’t think so.

Of course, we wouldn’t be talking about this case if there wasn’t a tipping point. That tipping point came at the end of 2019, when RLMC filed for bankruptcy protection. Ratcliff, by all accounts, was identified as an unsecured creditor, which he vehemently disagreed with. He told the court that although he didn’t amend it for the debtor name change, “his filings subsequent to that date “revived” the lapse of perfection and operated to “re-perfect” the Financing Statement.”

Yeah, that’s not how this works. You can’t revive your UCC; it’s not like the UCC passed out and you can wave smelling salts under its proverbial nose. When you know your security interest has become unperfected, because you failed to amend the filing timely, that’s it, game over.

The court supported “game over” when it referenced 9-515 of Minnesota’s UCC statute:

336.9-515 DURATION AND EFFECTIVENESS OF FINANCING STATEMENT; EFFECT OF LAPSED FINANCING STATEMENT.

(c) Lapse and continuation of Financing Statement. The effectiveness of a filed Financing Statement lapses on the expiration of the period of its effectiveness unless before the lapse a Continuation Statement is filed pursuant to subsection (d). Upon lapse, a Financing Statement ceases to be effective and any security interest or agricultural lien that was perfected by the Financing Statement becomes unperfected, unless the security interest is perfected otherwise. If the security interest or agricultural lien becomes unperfected upon lapse, it is deemed never to have been perfected as against a purchaser of the collateral for value.

Ratcliff persisted with his argument further by claiming the actions he did take were to “connect the dots” from his original UCC filed in 2010 to the amendment filed in 2019. The court didn’t buy it: “Just because Ratcliff ‘eventually’ got around to attempting to connect the disjointed and ineffective ‘dots’ he had filed does not mean that he was able to revive his interests or that either of his UCC-3 filings was effective.”

Relentless-Ratcliff (my new nickname for him) leveraged any argument he could come up with, and one by one the court shut him down.

“Ratcliff’s interpretation of the UCC does not create a harmonious result. Instead, under his theory, a creditor could re-perfect a lapsed security interest by simply filing a Continuation Statement — and a “seriously misleading” one, at that — at essentially any time, as long as it later filed an Amendment to that statement. This would fly directly in the face of the clear directive of Minn. Stat. § 336.9-507(c)(2). Why include directions about a timeframe within which an Amendment to a “seriously misleading” filing statement must be filed if it could, in fact, be filed at any time?”

Sorry Relentless-Ratcliff, your security interest is avoidable. However, being that he is relentless, he is appealing the decision handed down by the Minnesota Bankruptcy Court.

And, since the above decision was handed down, Ratcliff has won a motion for stay on the sale of all assets of debtor.

“…[T]his Court concludes that Ratcliff met his burden to show that the sale should be halted while he seeks to reverse his unsecured status on appeal and grants Ratcliff’s motion to stay pending appeal so long as he posts a supersedeas bond.”

Guess we’ll have to wait and see what happens in the next episode of “Relentless-Ratcliff and His Rogue Security Interest.”