Is the Subcontractor’s Foreclosure Action Out? Here’s a Look at a Case in Utah.

In Garlett Construction, Inc. v. Leonard, Dist. Court, D. Utah 2016, the owners tried their darnedest to contest the validity of the subcontractor’s foreclosure action, but ultimately struck out.

The Players

- Project: Residence in Moab, Utah

- Owners: Curtis & Genevieve Leonard

- General Contractor: White Horse

- Claimant/Subcontractor: Garlett Construction, Inc.

The 3 Pitches

The Leonard’s were contesting Garlett’s foreclosure action for 3 reasons.

- Garlett is an unlicensed contractor

- Garlett’s preliminary notice is defective

- Garlett signed lien waivers, waiving their right to enforce a mechanic’s lien

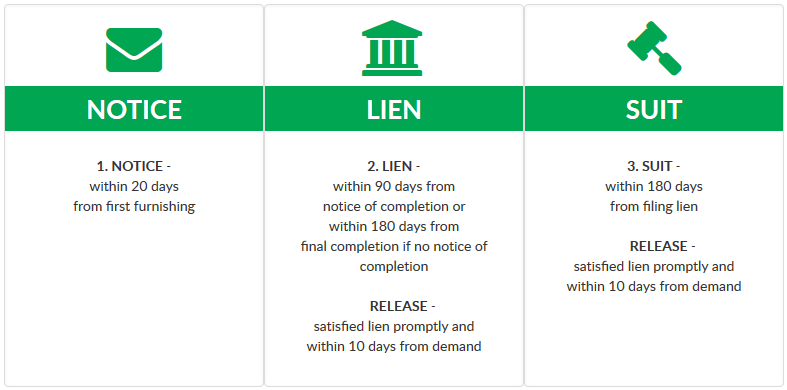

First, here’s a quick overview of the necessary steps for securing mechanic’s lien rights in Utah.

The above is for commercial or residential projects, however, there is one additional note for those furnishing to residential projects:

“If the owner can prove compliance with the requirements of the Residential Lien Recovery Fund, the lien will have to be released. The claimant can apply to the fund for payment of the claim provided a judgment has been obtained against the debtor and the claimant is registered with the fund. Suit to enforce a claim under the Lien Recovery Fund must be filed within the earlier of 180 days from filing the lien or 270 days from completion of the original contract.” – The National Lien Digest

A Swing & A Miss

The first issue is whether or not Garlett could proceed with their foreclosure action based on the validity (or lack thereof) of their contractor’s license. Although there were minor discrepancies with their licensure, the court determined that Garlett is a licensed contractor.

Strike Two…

The second issue is whether or not Garlett’s preliminary notice was valid. The Leonards argued that Garlett’s preliminary notice was invalid because it did not comply with requirements set forth by the Residence Lien Restriction and Lien Recovery Fund Act.

Unfortunately for the Leonards, these provisions apply to the general contractor and/or real estate developer and Garlett’s contract was with the general contractor, making them exempt from these requirements.

That didn’t satisfy the Leonards and they took it one step further, stating Garlett’s notice didn’t comply with statute, because the notice filed with the State Construction Registry “indicated” that Garlett’s contract was with the owner. Again, the court sided with Garlett. It turns out, statute and the State Construction Registry aren’t 100% in sync.

“the Leonards’ ‘Unconditional Lien Waivers’ are unenforceable. ‘[T]he sole criteria for the execution of an effective lien waiver are … the execution of a “waiver and release signed by the lien claimant or the lien claimant’s authorized agent,” and the receipt of “payment of the amount identified in the waiver and release”’… The Leonards’ ‘Unconditional Lien Waivers’ do not identify any amount for which those waivers purportedly apply, nor is there any evidence of record that GCI was paid any amounts in connection with those waivers.”

Strike 3, You’re Out!

On to the third issue. In its final issue, the Leonards argued that Garlett gave up their right to foreclose their mechanic’s lien, because Garlett signed unconditional lien waivers.

Although Garlett signed these waivers, which were supplied by the Leonards, the waivers didn’t comply with statute, making them null & void.

“… the Leonards “Unconditional Lien Waivers” are unenforceable. “[T]he sole criteria for the execution of an effective lien waiver are … the execution of a `waiver and release signed by the lien claimant or the lien claimant’s authorized agent,’ and the receipt of `payment of the amount identified in the waiver and release… The Leonards’ Unconditional Lien Waivers” do not identify any amount for which those waivers purportedly apply, nor is there any evidence of record that GCI was paid any amounts in connection with those waivers.”

Garlett Pulls Ahead

At this point, Garlett is in the lead. They filed their preliminary notice, filed their mechanic’s lien & commenced a foreclosure action; all of which have been deemed valid by the courts. However, this decision is recent and will likely see more litigation.

Takeaways

- Check state requirements for contractors’ licenses to insure you are in compliance.

- Although the SCR has a particular format for preliminary notices, it’s important to list all parties within your contractual chain.

- Watch the Waiver! Be cautious when signing lien waivers. The Garlett’s lucked out, because the Leonards’ waivers didn’t contain required information. But if it had contained the necessary info, Garlett could have lost all rights.