Alternative A in Action: The Debtor’s Name as it Appears on the Unexpired Driver’s License — Even if it’s Incorrect

In a recent court decision, one creditor’s security interest was eliminated because they spelled the individual debtor’s name correctly.

Yes, I said “correctly.” Because, in this case, “correctly” and “as the name appears on the driver’s license in compliance with § 9-503(a)” resulted in two different spellings of the debtor’s name.

Case Background

In 2014 and 2015, MainSource Bank (MainSource) entered into two different loan agreements with the debtor (specific to this case is debtor Ronald Nay). With each loan agreement, there was a signed security agreement and MainSource filed the appropriate UCC Financing Statements toperfect their security interest.

At the end of 2015, LEAF Capital Funding, LLC (LEAF), executed an agreement with one of the debtors, Ronald Nay, for the purchase of two pieces of equipment. With the finance agreement, LEAF also obtained a signed security agreement and subsequently filed a UCC Financing Statement to perfect their security interest.

In May 2016, the Nays filed for bankruptcy protection. As a presumed secured creditor, LEAF filed their proof of claim in September 2016, and soon after, MainSource filed a complaint arguing that LEAF did not have a perfected security interest.

The court agreed with MainSource, leaving LEAF with an unperfected security interest.

The Difference Between Two Financing Statements

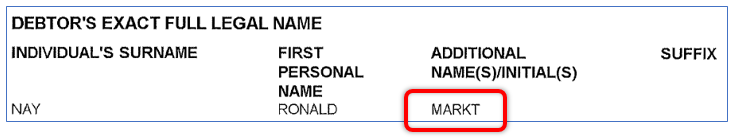

MainSource’s UCC identifies the debtor as “Ronald Markt Nay” (emphasis added) which is not how Ronald spells his middle name, it is however, the way Ronald’s name appears on his driver’s license.

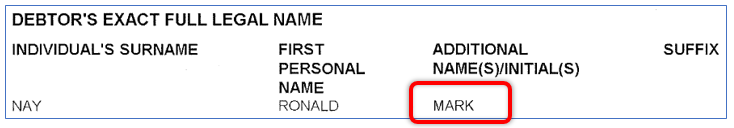

LEAF’s UCC identifies the debtor as “Ronald Mark Nay” (emphasis added) which is the correct spelling of Ronald’s middle name, but not the spelling as it appears on his driver’s license.

Why is LEAF’s UCC unperfected? After all, LEAF correctly spelled Ronald Nay’s middle name!

Because, to be compliant with Alternative A under § 9-503(a), the debtor’s name must appear on the UCC Financing Statement exactly as it appears on the unexpired driver’s license.

The Amendments & The Alternatives

July 1, 2013. A day that will live in infamy! That is, if you are familiar with Article 9 of the Uniform Commercial Code, as it is the date the 2010 Amendments went into effect.

One issue addressed in the 2010 Amendments was how to determine the debtor’s name as it should appear on the UCC Financing Statement.

In compliance with § 9-503(a), when the debtor is a registered organization, creditors should rely on the information found on the public organic record.

If the debtor is an individual, creditors must first look to the state’s legislation. With the 2010 Amendments, each state had to decide whether they would implement “Alternative A” or “Alternative B.”

- Alternative A: if the debtor holds an unexpired driver’s license, the Financing Statement must list the debtor’s name as it appears on the unexpired driver’s license. (If the debtor does not have a driver’s license, the Financing Statement should list the “individual name” of the debtor or the debtor’s surname and first personal name.)

- Alternative B: the debtor’s driver’s license name, the debtor’s actual name or the debtor’s surname and first personal name may be used on the Financing Statement.

Most states opted to enact Alternative A, including Indiana — the state where Nay is located and the Financing Statements are filed.

Seriously Misleading or Minor Error

In its decision, the court admitted the spelling error on LEAF’s UCC was minor, and per Indiana Code § 26-1-9.1-506(a) “A financing statement substantially satisfying the requirements…is effective, even if it has minor errors or omissions, unless the errors or omissions make the financing statement seriously misleading.”

But, per code § 26-1-9.1-506(b), “Except as otherwise provided in subsection (c), a financing statement that fails sufficiently to provide the name of the debtor in accordance with IC 26-1-9.1-503(a) is seriously misleading.” So, we must circle back to IC 26-1-9.1-503(a), which is Alternative A, and is, in fact, the technicality that invalidated LEAF’s security interest.

“§ 26-1-9.1-503(a)(4) … if the debtor is an individual to whom this state has issued a driver’s license or an identification card for nondrivers under IC 9-24-16 that has not expired, only if the financing statement provides the name of the individual which is indicated on the driver’s license or identification card.”

The Court

As you may know, the UCC is considered seriously misleading, thus invalid, if a search of the debtor’s name does not reveal the UCC. The court held that LEAF’s UCC would not have been uncovered via a search using standard search logic.

“In this case, considering the plain language of the statute, given its ordinary meaning, and reading section 503 together with section 506, it seems clear that the “only” correct name of the Debtor under section 503 is the name on his Indiana driver’s license, Ronald Markt Nay. Section 506 provides relief to LEAF only in as much as a search of the debtor’s “correct” name (as established by section 503), using standardized search logic, would reveal its financing statement. It does not.”

Parting Thoughts

At face value, this opinion seems quite extreme. But it is a clear reminder that compliance is king. Use caution when identifying your customer on the UCC filing, whether it is an organization or an individual. If it’s an individual, carefully list their name exactly as it appears on their unexpired driver’s license.

If you have questions regarding this recent court decision or UCC filings, please contact NCS today!