While Credit Insurance Companies Slash Coverage, Credit Professionals Shift Focus to UCC Filings

As the economy struggles to realign, businesses are scrambling and struggling to keep the supply chain in motion, but the financial risks are staggering. Sales teams are pushing for customers to have access to larger credit limits and credit teams are pushing back because the financial protections they once relied on have vanished. Suppliers have widely used credit insurance to protect their accounts receivable, but credit insurance companies continue to cut coverage and slash policies to maintain their own bottom lines. While insurance companies deliver crippling blows to businesses’ financial security, credit departments have been carefully reevaluating risk mitigation strategies, and it’s brought UCC filings into renewed focus.

Credit Insurance Turbulence

Credit insurance, also known as trade credit insurance or accounts receivable insurance, insures a creditor’s accounts receivable against a debtor’s nonpayment, insolvency, or bankruptcy. Credit insurance is a widely used, internationally accepted, risk resource and is commonly used in European and Asian countries.

When the economy is good, obtaining and maintaining credit insurance is reasonably uneventful. When the economy is bad, insurers start dropping marginal accounts and overall portfolios like a bad habit, leaving creditors unprotected.

The pandemic has truly taken its toll on all facets of the economy, including credit insurance. In difficult economic times, more businesses are going to fail; this means more insurance claims and more insurance payouts. I’ll let you in on the worst kept insurance secret: insurance companies are in the money-making business, not the money-losing business. So, to save the insurance company money, your policies are taking a hit. One source cited insurance coverage had been slashed by 15%, across all industries amid the pandemic, in an effort to balance their own books: “James Daly, CEO of credit insurer Euler Hermes North American, said his company has had to scale back coverage across all industries by 15%, including retail.”

15%! Can you afford the financial burden of lost coverage on your riskiest accounts? Are the high premiums you pay worth the losses you will incur because your coverage has been slashed?

UCC Filings, Your Security Interest Awaits

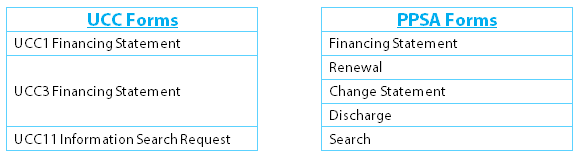

Article 9 of the Uniform Commercial Code (UCC) provides an opportunity for trade creditors to secure goods and/or accounts receivable by leveraging the personal property assets of their customer. Under UCC Article 9, a security interest is an interest in personal property or fixtures and secures payment or performance of an obligation. Before extending credit, many creditors require their debtors to enter into a security agreement. The debtor will pledge specific personal property as collateral to grant a security interest to the creditor. Then, in the event of debtor default, the creditor can use the collateral to recover payment. Typically, the collateral can be sold to reduce the debt. Then, any surplus proceeds belong to the debtor and, vice versa, any deficit is still an obligation of the debtor.

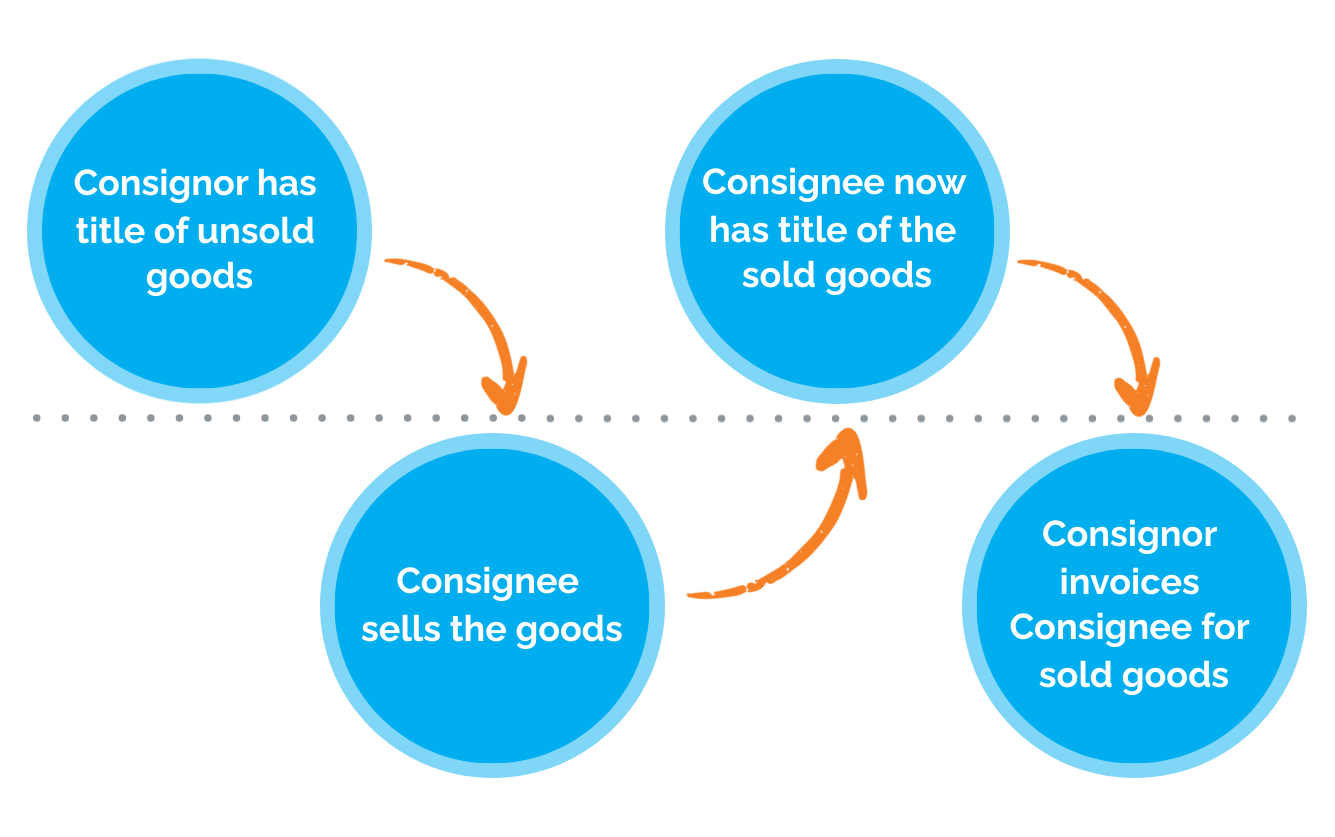

Included under the Article 9 umbrella are all forms of consignment and letter of credit payment rights that support the payment or performance of other collateral. Article 9 applies to leases if the parties intend that the lease provide security, as well as sales of account and chattel paper, including pledge, chattel mortgage, conditional sales, trust receipts, and field warehousing.

A Financing Statement is effective for 5 years (10 years in Wyoming), and if a Continuation is not filed timely, the Financing Statement will lapse, and the Security Interest will be extinguished. Once the debtor fulfills the obligation, a Termination should be filed.

Why UCC Filings?

Now, more than ever, you need to protect your receivables and it’s become too expensive and risky to pursue that protection solely through credit insurance. Yes, credit insurance may still be the best option for securing export (international) transactions, but domestically (plus Mexico, Canada, Australia & New Zealand) consider UCC filings or at least supplement credit insurance with UCC filings.

The Costs

The cost of filing a UCC is nominal compared to the premiums and deductibles of credit insurance. Credit insurance premiums may range between 0.2% – 0.8% of your company’s estimated annual sales. If your company sells approximately $10 million a year, the annual premium to cover the entire AR could be $20,000 – $80,000. UCC filings cost approximately $200 per filing and filings are in place for 5 years. With UCCs, you don’t have to deal with annual premiums, deductibles, etc. UCCs are a low-cost solution, ensuring you aren’t throwing good money away.

Pick & Choose

With UCC filings, you choose the accounts to secure, you set the risk threshold, you are in control. Credit insurance companies are in the business of making money – they aren’t charity organizations. You will be required to insure good accounts to justify insurance on the riskier accounts. This way the insurance company collects premiums on the accounts that are likely to remain solvent, to make up for the money they will pay out on the accounts likely to default.

UCCs Don’t Judge

Unlike credit insurance, UCC filings aren’t judgmental. A UCC isn’t going to cease simply because your customer’s risk profile changes. The state of Delaware isn’t going to contact you and say “Listen, we see your customer’s debt has grown, so we’re going to have to unperfect your UCC.” UCC filings will secure your receivables if you have properly perfected the security interest, regardless of your customer’s creditworthiness or the economic climate.

The Value of Public Record

Let’s not forget the immense value of the public record. Recording your Financing Statement creates a public record; it is a public acknowledgement of the financial agreement. This can be invaluable in a volatile economy. As an example, if you have filed a UCC and your customer decides to sell its business without telling you, that UCC is out there in the public record and can halt the sale, helping to ensure you are paid. Credit insurance doesn’t do that.

More Sales

As you know, the business world is aggressively competitive. UCC filing is more than reducing risk; it’s about the opportunity to expand your market, by providing you with the security needed to sell to marginal accounts and by providing the added security needed to increase existing clients’ credit lines. UCC filings create a competitive advantage.

Credit Insurance and UCC Filings

Credit insurance certainly has its place in the global economy. After all, it’s insurance, powered by actuaries who carefully evaluate risk, which alleviates the burden on your credit department to analyze and monitor accounts. But, for those supplying domestically, UCC filings offer the security needed to extend credit at a fraction of the cost. As insurance companies cut your portfolio coverage, perhaps you should consider supplementing coverage with UCC filings. Pay for and use the credit insurance for the amount the insurance company is willing to insure, then file a UCC to provide security on the outstanding balance. You don’t have to pick one or the other – it’s not credit insurance OR UCCs, it’s credit insurance AND UCCs.

Editor’s Note: This content was originally published 2020. It has since been updated and revised for 2023