It’s A 180 On The 180 Equipment, LLC Decision: The Collateral Description of “See Attached”

An Illinois Court of Appeals has reversed the Bankruptcy Court’s decision in 180 Equipment, LLC v First Midwest Bank, which had allowed the bankruptcy trustee to avoid the security interest of First Midwest Bank.

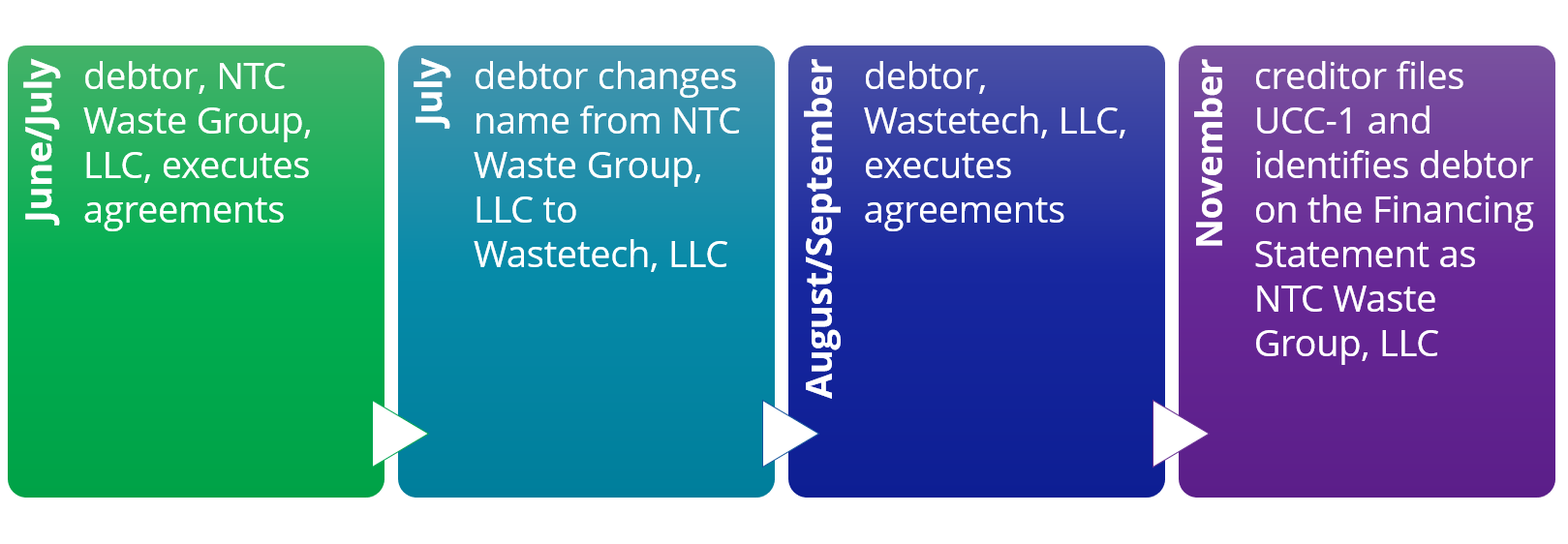

Recap of Events from What Happens When a UCC-1 Collateral Description References the Security Agreement?

180 Equipment, LLC (180 Equipment) obtained a loan from First Midwest Bank (Bank) and granted Bank a security interest in 26 specifically identified “categories of collateral, including accounts, chattel paper, equipment, general intangibles, goods, instruments and inventory and all proceeds and products thereof.”

In its Financing Statement, Bank identified the collateral as “All Collateral described in First Amended and Restated Security Agreement dated March 9, 2015 between Debtor and Secured Party.” However, Bank did not include the Security Agreement with the filing of its Financing Statement.

When 180 Equipment filed for bankruptcy protection, the trustee argued that Bank’s security interest was unperfected because it failed to sufficiently describe the collateral. “The trustee… contends that the mere reference to the collateral as being described in the amended security agreement does not suffice to indicate, describe or reasonably identify any collateral.”

Bank argued the filing of the Financing Statement was enough to put other creditors on notice. “…the purpose behind the filing of a financing statement is merely to provide notice to third-party creditors that property of the debtor may be subject to a prior security interest, and that further inquiry may be necessary to determine the identity of the collateral.”

The Bankruptcy Court’s decision? The Bankruptcy Court agreed with the trustee. Bank’s Financing Statement failed to sufficiently identify the collateral. Referring to the Financing Statement, the Bankruptcy Court states “Rather, it attempts to incorporate by reference the description of collateral set forth in a separate document, not attached to the financing statement. The financing statement, on its face, provides no information whatsoever, and therefore no notice to any third party, as to which of the Debtor’s assets First Midwest is claiming a lien on, which is the primary function of a financing statement.”

The Appeals Court Reversed the Bankruptcy Court Decision

As mentioned above, Bank argued its Financing Statement was enough to put other creditors on notice. Although the Bankruptcy Court ruled against Bank’s argument, the Court of Appeals agreed with Bank.

How did the Appeals Court determine Bank’s Financing Statement complied with Article 9? In the Appeals decision, the Court focused on the plain language of Article 9. Specifically, the Court reviewed §9-502, §9-504 and §9-108. These sections are paraphrased below:

9-502: Financing Statement is sufficient if it includes the name of the debtor, the name of the secured party, and indicates the collateral.

9-504: Financing Statement is sufficient if it provides “a description of the collateral pursuant to Section 9-108” or “an indication that the financing statement covers all assets or all personal property.”

9-108: Examples of Reasonable Identification include “(1) specific listing; (2) category; (3) except as otherwise provided in subsection (e), a type of collateral defined in [the Uniform Commercial Code]; (4) quantity; (5) computational or allocational formula or procedure; or (6) except as otherwise provided in subsection (c), any other method, if the identity of the collateral is objectively determinable.”

Did I indicate a possible trend? In its decision, the court aimed to define “indicates.” Ultimately, if the Financing Statement indicates the collateral description, the requirements under §9-502 are satisfied.

“…the ordinary meaning of ‘indicate’ is to serve as a ‘signal’ that ‘point[s] out’ or ‘direct[s] attention to’ an underlying security interest. That plain reading of the text allows a party to ‘indicate’ collateral in a financing statement by pointing or directing attention to a description of that collateral in the parties’ security agreement.”

That definition of indicates means Bank’s Financing Statement’s reference to the Security Agreement is sufficient — because it directs subsequent creditors to the Security Agreement.

The Appeals Court states the onus lies with subsequent creditors. If a creditor’s search turns up a Financing Statement and the Financing Statement references the collateral in the security agreement (e.g. “See Security Agreement), the creditor should then request a copy of the Security Agreement to confirm whether there is a conflicting interest in the collateral.

“While financing statements and security agreements both must describe the collateral, ‘the degree of specificity required of such description depends on the nature of the document involved—whether it is a security agreement or a financing statement…’ The ‘prudent potential creditor would request a copy of the security agreement,’ and ‘need look no further than the security agreement’ to resolve questions about the adequacy of the collateral description. The different treatment of these two documents highlights the distinct function each serves under Article 9: the financing statement provides notice of an underlying security interest, while the security agreement creates and specifically defines that interest.”

What a Win! But, Take Precautions

Although the Court of Appeals has reversed the Bankruptcy Court’s decision, as a best practice you should ensure the Financing Statement provides a collateral description, and if attachments are referenced the attachments should be recorded with the Financing Statement.