There’s No Ice Cream in Bankruptcy. Wait, What?!

In bankruptcy, we frequently hear terms like preference payment, claw back, and new value. What do these terms mean? Further, what do these terms have to do with ice cream?

Let me tell you a little story about an ice cream truck and its weekly deliveries to a now insolvent grocery store.

The Ice Cream Truck – Music to My Ears!

Blue Bell Creameries, Inc. (Blue Bell) supplies ice cream and related items to a variety of businesses, including a grocery store chain, Bruno’s Supermarkets, LLC (Bruno’s). Each week, Blue Bell would deliver ice cream to Bruno’s and twice a week Bruno’s would remit payment to Blue Bell.

Soon, Bruno’s payments dropped from twice a week to once a week. Blue Bell continued its routine deliveries, after all, Bruno’s wasn’t paying twice a week, but Bruno’s was still paying within terms. Then Blue Bell began hearing rumors about Bruno’s cash flow problems, even the possibility that Bruno’s was preparing for bankruptcy. Technically, Blue Bell was still receiving timely payment from Bruno’s — what should Blue Bell do?

Blue Bell decided to continue supplying to Bruno’s, all the way to the date of bankruptcy. Soon after Bruno’s bankruptcy filing, Blue Bell found itself scooped into a lawsuit: the bankruptcy trustee wanted to recover ALL payments Blue Bell received from Bruno’s during the 90 days prior to the bankruptcy filing, to the tune of over $500,000.

Ice Cream Break

This period, the 90 days prior to the date of the bankruptcy filing, is also known as the preference period. Payments made during the preference period are often referred to as preference payments. The court opinion defines preference as

“… as defined by § 547(b), a preference occurs when an insolvent debtor transfers money to pay a creditor for a prior debt within 90 days before filing a bankruptcy petition.”

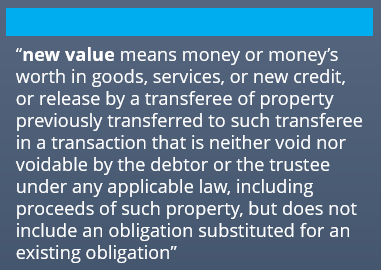

Claw backs and Happy Tracks. One of these is a term for the bankruptcy trustee obtaining preference payments from creditors and the other is a delicious ice cream treat. You guessed it, the act of obtaining these payments is known as claw back. “The trustee will claw back payments from the creditor.” A defense against preference or to alleviate claw backs? New value.

Back to Blue Bell

Blue Bell recognized and admitted based on 547(b) of the bankruptcy code the trustee could claw back the money Bruno’s paid Blue Bell. (It’s the “ordinary course of business” defense)

But this story wouldn’t be as sweet if it stopped now. Blue Bell argued the payments it received from Bruno’s provided “new value” which is in line with 547(c).

I like the bankruptcy court’s explanation of new value for this case

“… lots of ice cream products that [Bruno’s] was able to sell to its customer in its efforts to remain financially afloat.”

If the court agreed with the new value defense, the trustee couldn’t go after those payments. But the court didn’t agree, stating the new value defense requires the new value to remain unpaid.

There is a confusion related to the idea of remaining unpaid. I’m not going to create a brain freeze by explaining too much about it, but here’s a high level look:

Essentially, Blue Bell wouldn’t have been permitted to use the new value defense because Bruno’s actually paid them for the goods Bruno’s received from Blue Bell — Blue Bell could have used the new value defense if it continued supplying to Bruno’s and Bruno’s didn’t pay them.

Fortunately for Blue Bell, the Court of Appeals determined Blue Bell could use the new value defense, despite payments received from Bruno’s. Why?

In part, it’s because the “one of the ‘principal policy objectives underlying the preference provisions of the Bankruptcy Code’ is ‘to encourage creditors to continue extending credit to financially troubled entities while discouraging a panic-stricken race to the courthouse.’” Despite the rumors, and subsequent realities of Bruno’s fiscal situation, Blue Bell continued to supply its delicious treats.

You can view the Court of Appeals case here: Kaye v. Blue Bell Creameries, Inc.

UCC the Proverbial Sundae Topper

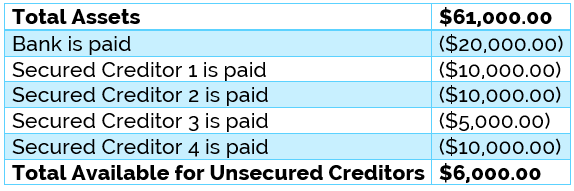

Could a properly perfected security interest have saved Blue Bell from this melty mess? Quite possibly. A properly perfected UCC provides an additional defense against preference payments.

We’ve previously discussed the higher risks of supplying to foodservice, beverage and hospitality industries. This is no different. Never assume, no matter how large your customer is, your customer is immune to insolvency. File UCCs and ensure you are in the best possible position to get paid.